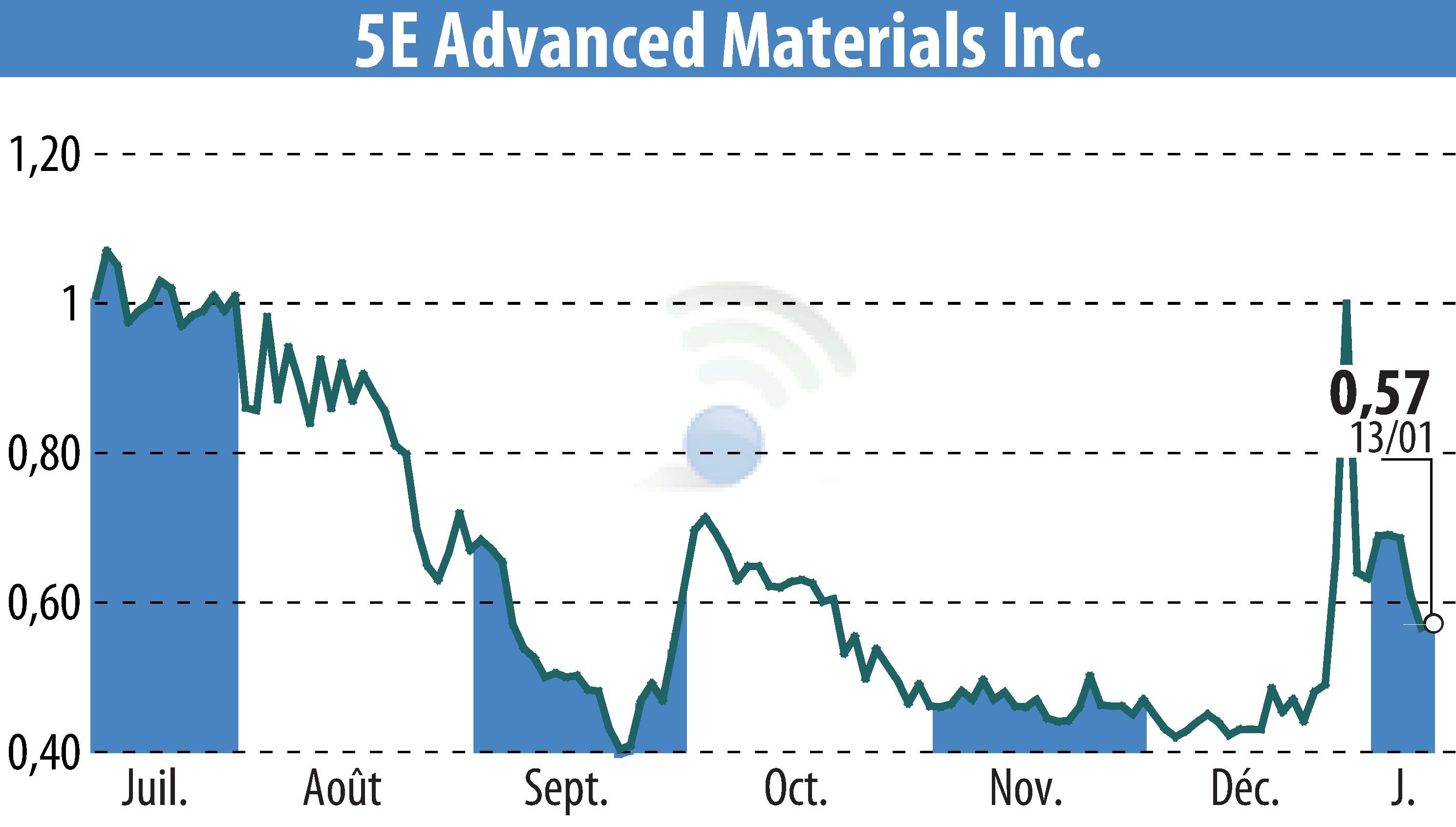

sur 5E Advanced Materials (NASDAQ:FEAM)

5E Advanced Materials Secures $30 Million Funding and Restructures Convertible Notes

5E Advanced Materials, Inc. has announced a restructuring agreement aimed at enhancing its balance sheet with a $30 million funding package. The agreement involves key lenders, including Ascend Global Investment Fund SPC, Bluescape Special Situations IV LLC, and Meridian Investments Corporation. The transaction proposes the full equitization of all senior secured convertible notes, issuing over 312 million shares of common stock to lenders.

Subject to shareholder approval, the lenders will purchase an additional $5 million of common stock. They will also receive one-year warrants to purchase further shares, potentially worth $20 million. Post-restructuring, Ascend and BEP will nominate two directors each to the company's board.

CEO Paul Weibel believes the agreement will support 5E's transformation into a leading boric acid and boron advanced materials producer. The special stockholders meeting, anticipated in early 2025, will be crucial for the transaction's completion.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de 5E Advanced Materials