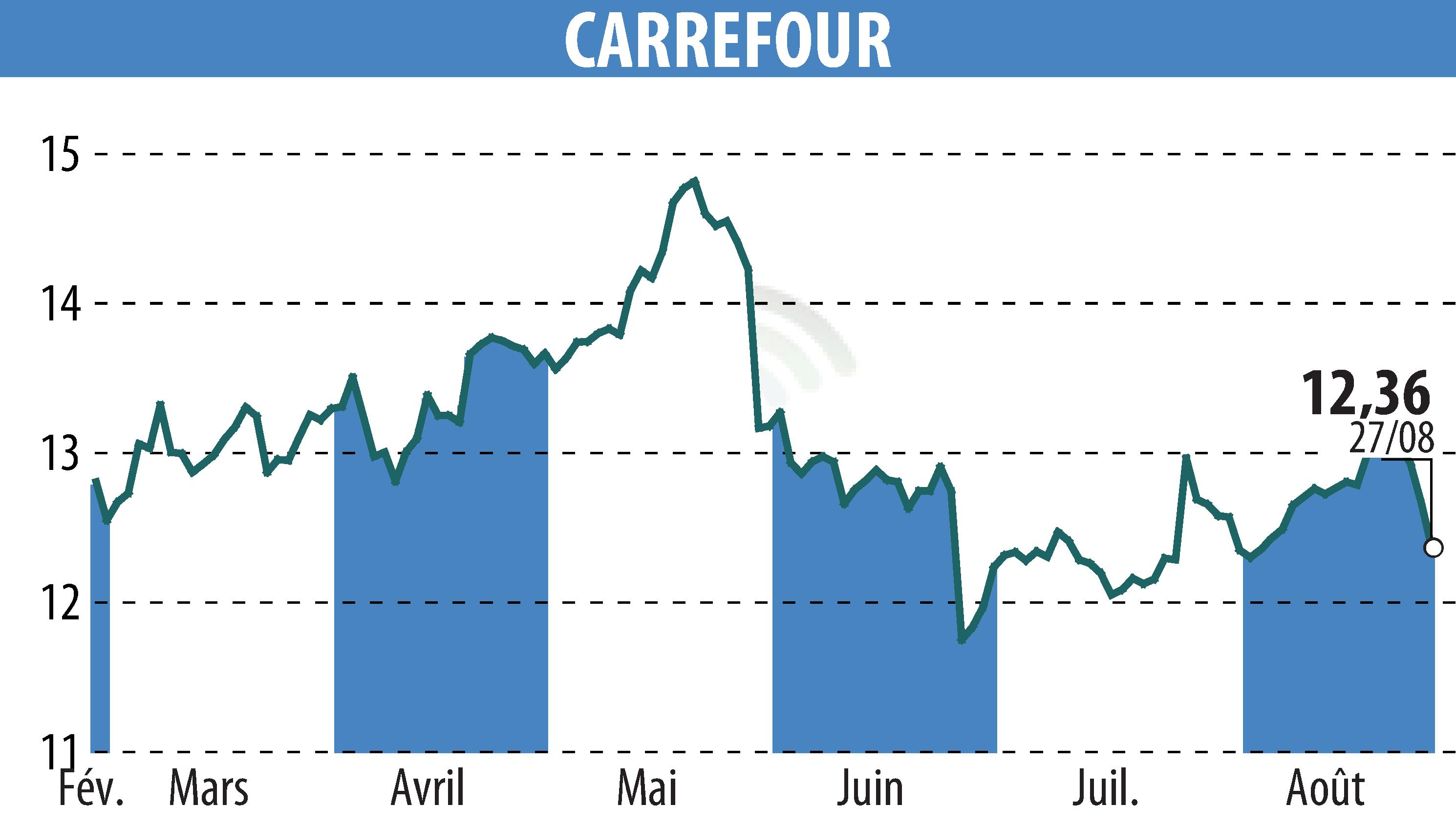

sur CARREFOUR (EPA:CA)

Carrefour Successfully Issues €500 Million Bond

On August 28, 2025, Carrefour completed the issuance of a €500 million bond. The bond, maturing in December 2028, carries a fixed coupon rate of 2.875% per annum with a bullet repayment format. The issuance was oversubscribed nearly sevenfold, reflecting investor confidence in Carrefour’s creditworthiness, which is supported by a "BBB" rating from Standard & Poor's.

The funds are earmarked for restructuring the debt of Carrefour's Brazilian subsidiary. Since the announcement on July 24, 2025, the group has refinanced over €1.4 billion of its Brazilian debt in euros. This restructuring is projected to enhance Carrefour's net free cash flow by approximately €100 million annually from 2026, also reducing financial expenses by €20 to €25 million in 2025.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de CARREFOUR