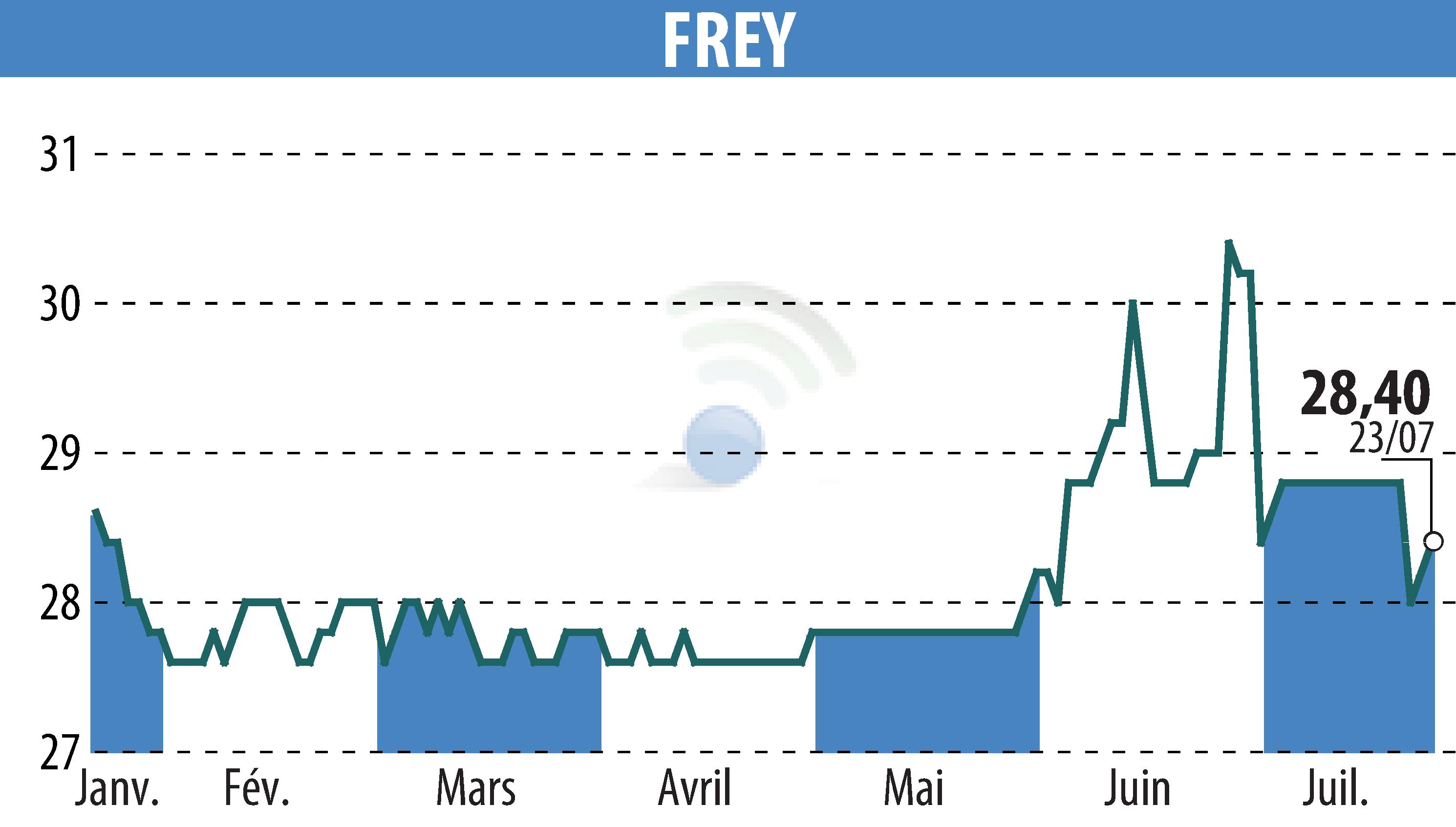

sur FREY (EPA:FREY)

FREY's H1 2025 Financial Results Highlight Strategic Expansion

FREY reported solid business activity in the first half of 2025. The company activated three growth drivers: active management, project pipelines, and strategic acquisitions. Despite a 6.3% drop in gross rental income to €65 million, annualised economic rental income increased by 13% to €156.5 million. The financial occupancy rate remained high at 99%, and the occupancy cost ratio low at 9.1%.

Key strategic actions included the repositioning of Shopping Promenade Riviera and acquisitions such as Designer Outlet Berlin. The Malmö Designer Village project commenced, representing a €100 million investment. However, revenue slightly decreased by 2.2% to €93.5 million due to disposals in 2024 affecting 2025 results.

FREY's long-term debt strategy and robust liquidity of €336.6 million sustain its growth initiatives. The renewal of its B Corp certification with an improved score highlights FREY’s commitment to sustainable business practices. Despite these achievements, profit from recurring operations fell by 8.3% to €51.1 million due to various strategic undertakings.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de FREY