sur HAMBORNER REIT AG (ETR:HABA)

HAMBORNER REIT AG: Stable Business Performance in Q1 2025

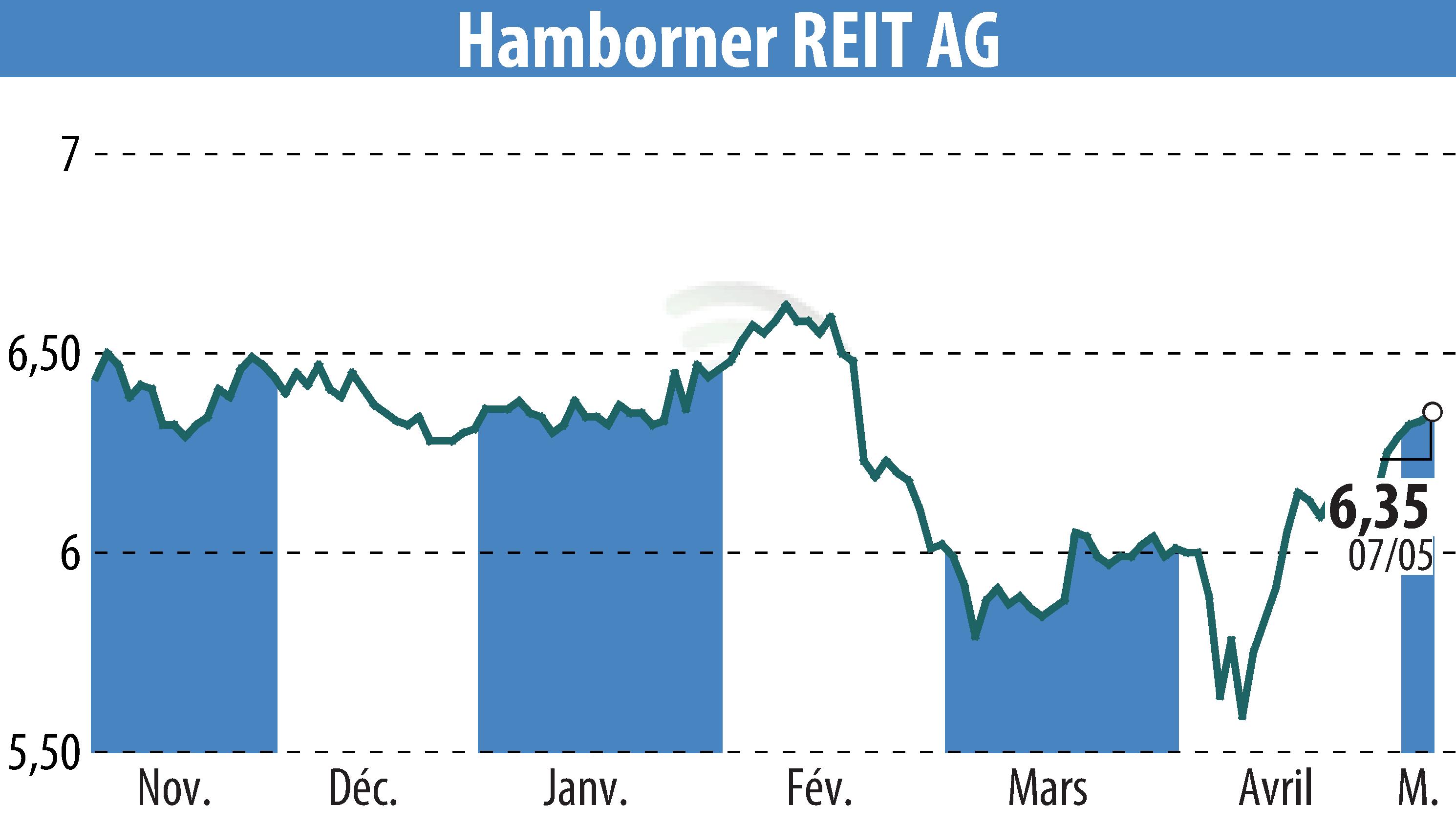

HAMBORNER REIT AG reports a stable business performance in early 2025, despite challenging market conditions. The firm's income from rents and leases fell by 1.7% to €23 million, impacted by delayed revenue-based rental payments and a property disposal in Hamburg. The funds from operations (FFO) declined by 15.2%, totaling €11.9 million, due to increased maintenance and operational costs, with FFO per share dropping to €0.15 from €0.17.

The company’s financial position remains solid, with a reduced loan-to-value ratio of 41.1%. The equity ratio increased to 56.0%, indicating a healthy balance sheet. The portfolio consists of 66 properties valued at €1.441 billion. The tenant retention rate is strong at 87%, and the vacancy rate remains low at 3.0%.

Looking ahead, HAMBORNER expects annual rental income of €87.5-89 million and an FFO between €44 million and €46 million. The annual general meeting on June 26 anticipates a proposed dividend of €0.48 per share, yielding 7.6% based on current share prices.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de HAMBORNER REIT AG