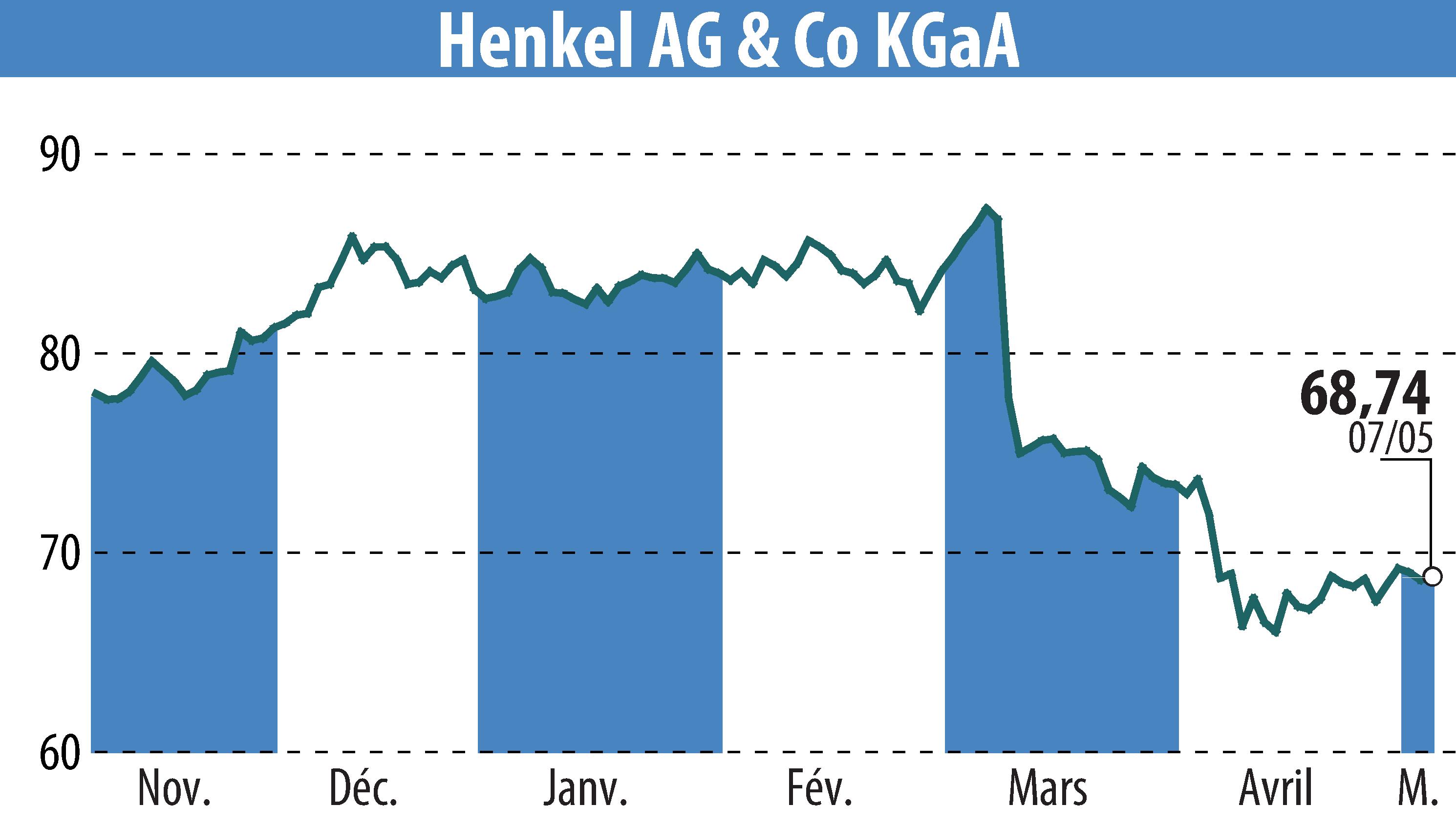

sur Henkel KGaA (ETR:HEN3)

Henkel Maintains Strong Profitability Amid Volatile Market Conditions

Henkel AG & Co. KGaA reported stable financial metrics for Q1 2025, with group sales around 5.2 billion euros, a slight decline from the previous year. Despite a 1.0% decrease in organic sales due to challenging geopolitical and macroeconomic conditions, Henkel's profitability remains robust. Adhesive Technologies showed positive growth, marking a 1.1% increase, driven by strong demand in Mobility & Electronics. Contrastingly, Consumer Brands faced a 3.5% decline, affected by subdued consumer sentiment and supply chain issues.

Henkel's strategic initiatives progressed with the completion of the Retailer Brands divestment in North America, refocusing efforts on branded consumer goods. The company anticipates organic sales growth between 1.5% and 3.5% for 2025. Despite increased market volatility, Henkel expects a stronger second half, driven by innovation and sustained brand investment.

Regionally, organic sales rose in IMEA and Asia-Pacific, while North America and Europe faced declines. Henkel's strategic focus on growth areas and efficient management underpins its optimistic outlook for the year, maintaining an adjusted EBIT margin target of 14.0% to 15.5%.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Henkel KGaA