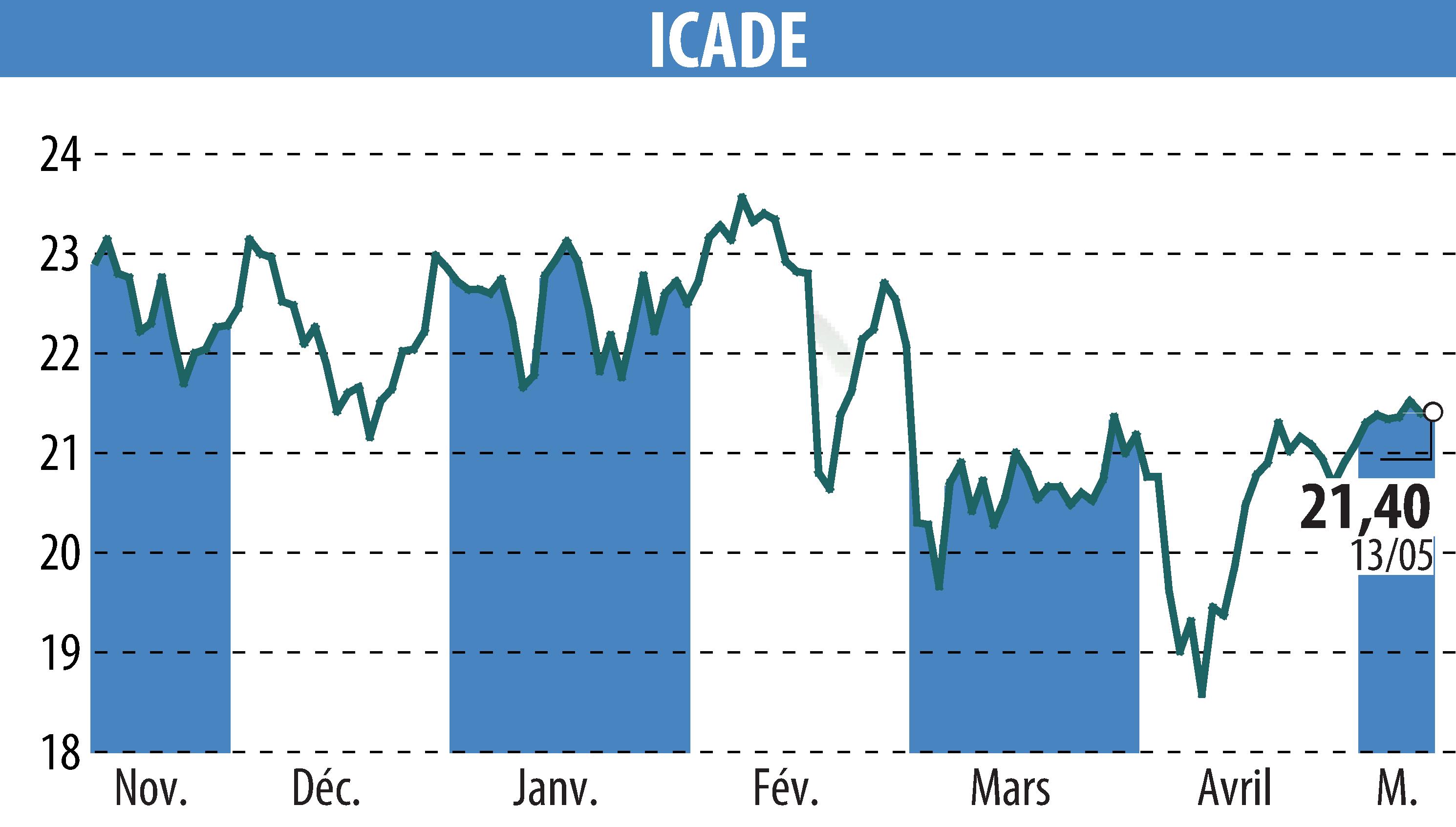

sur ICADE (EPA:ICAD)

Icade Announces New Green Bond Issuance and Cash Tender Offer

On May 14, 2025, Icade declared its plan to issue €500 million in 10-year green bonds, contingent on market conditions. Concurrently, the company launched a cash tender offer targeting four series of existing notes, prioritizing the €750 million and €600 million series due in 2026 and 2027, respectively. These notes currently hold outstanding amounts of €542.5 million and €600 million. The tender, capped at €250 million, will conclude on May 21, 2025.

This initiative allows Icade to manage its debt portfolio strategically while extending its financial timelines. BNP Paribas and other major banks are involved as Active Bookrunners and Dealer Managers, facilitating the issuance and tender offer processes. This financial maneuver is part of Icade's broader strategy to sustain its business operations and focus on sustainable urban development.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de ICADE