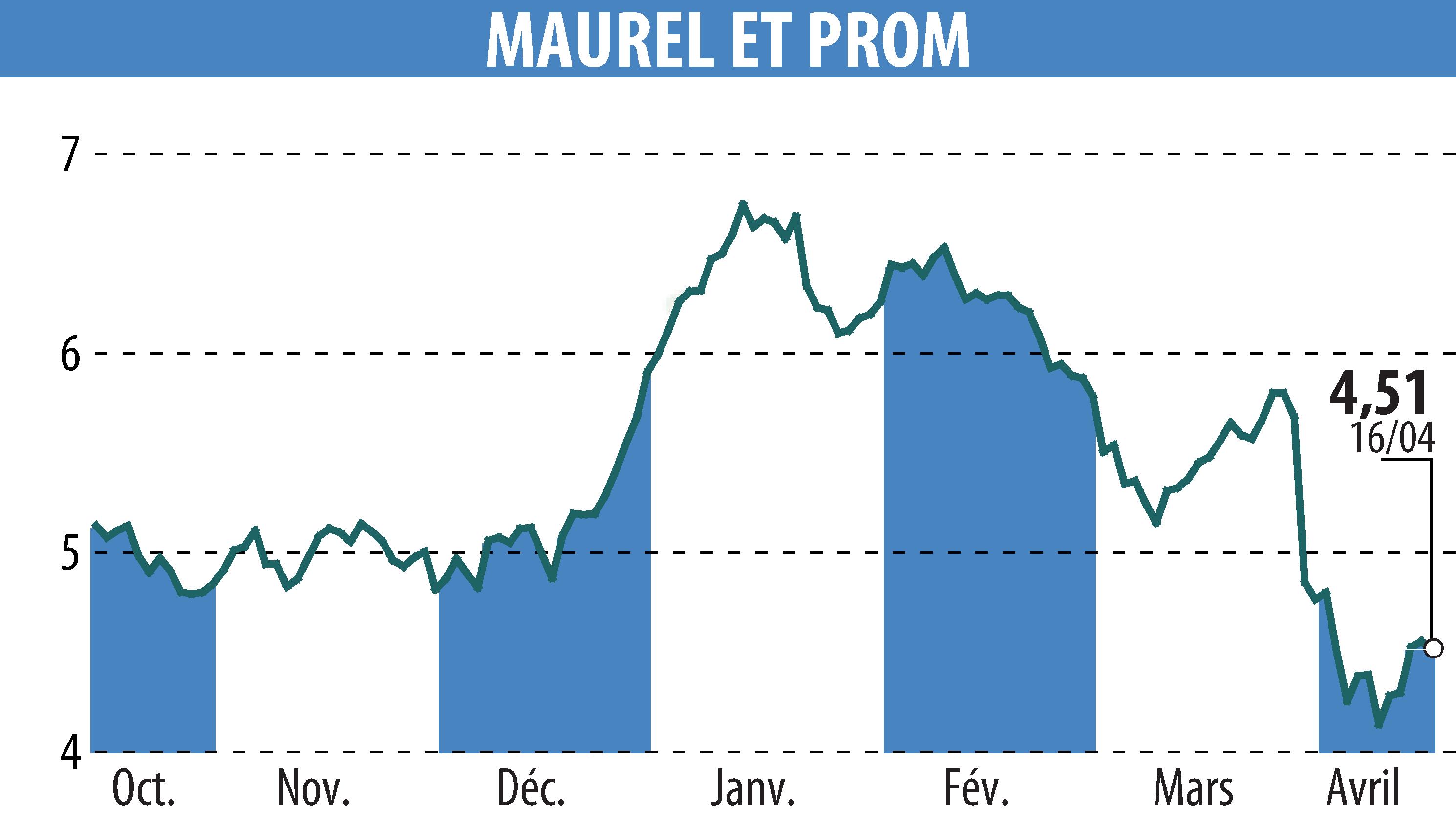

sur MAUREL & PROM (EPA:MAU)

Maurel & Prom's Q1 2025 Financial and Operational Update

Maurel & Prom (M&P) reported strong Q1 2025 performance with a 6% increase in production, reaching 38,534 boepd. This marks the company’s highest historical production level, showing growth across all assets. Gabon and Venezuela saw notable increases, up 6% and 9% respectively.

Valued production hit $136 million, up 3% from the previous quarter, despite a stable oil sale price of $74.9/bbl. However, sales dropped to $64 million due to a negative $76 million impact from lifting imbalances in Angola.

The company expects to complete its acquisition of a 40% stake in the Sinu-9 gas permit in Colombia by June. This project is anticipated to boost the production capacity significantly by Q3 2025.

Financially, M&P maintains a robust position with a $377 million liquidity buffer, supported by a net cash position of $50 million. A proposed dividend of €0.33 per share is planned for shareholders, pending approval in May.

R. H.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de MAUREL & PROM