sur MLP AG (ETR:MLP)

MLP SE Maintains Solid Outlook Amid Q1 Challenges

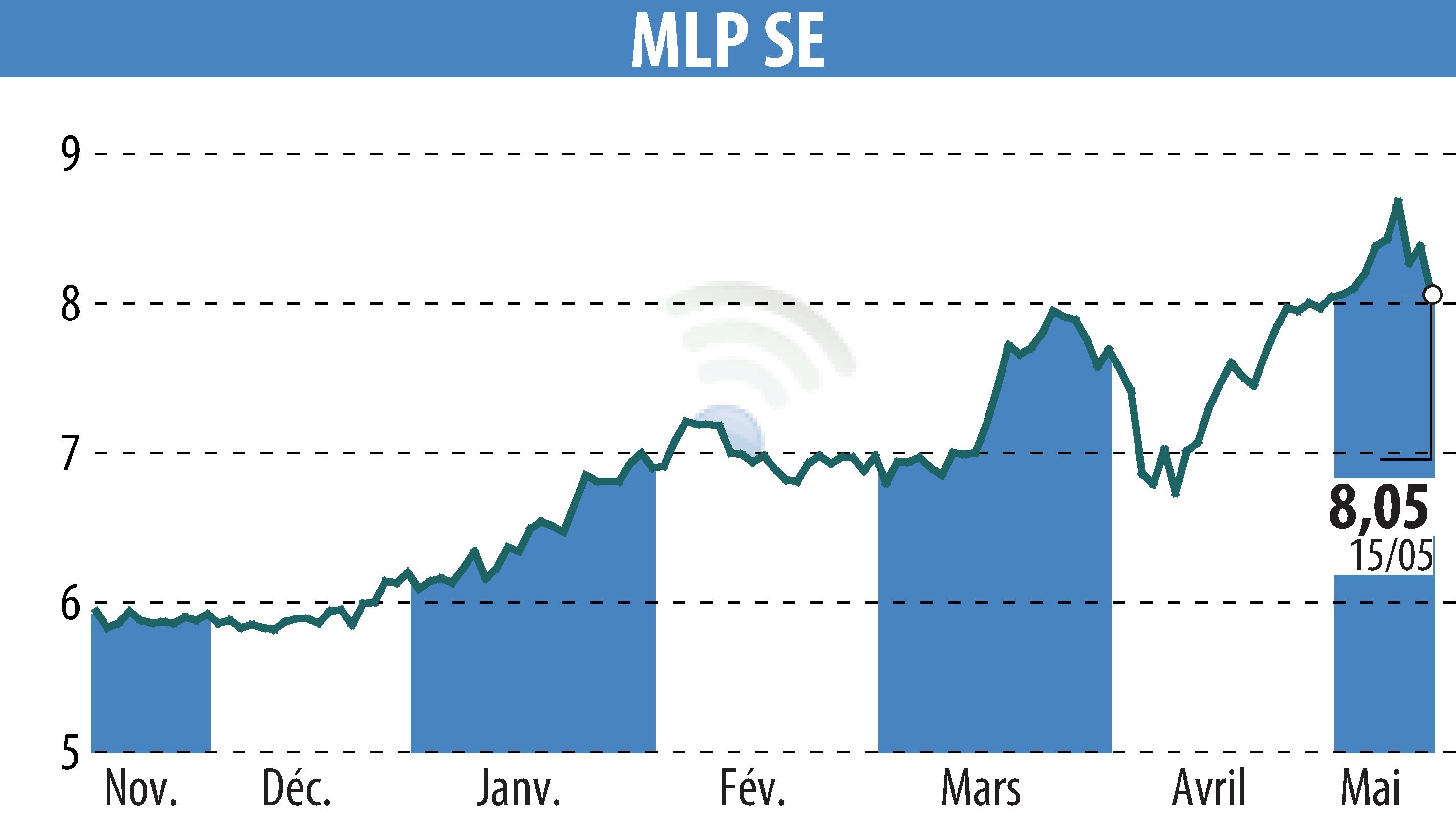

MLP SE's Q1 results showcased resilience despite slightly missing sales and EBIT expectations. Sales rose by 6% year-on-year to €301 million, with significant growth in Wealth and Life & Health segments. However, commissioned expenses, particularly in banking and real estate brokerage, impacted EBIT, which fell to €37.8 million.

Despite these challenges, underlying profitability improved with a 0.2pp increase in EBIT margin, excluding performance fees. The Financial Consulting and real estate segments provided support against declines in banking and asset management, helped by robust real estate brokerage recovery.

Assets under management remained stable at €62.8 billion, thanks to strong net inflows, offsetting broader market downturns. With rising brokerage margins and continued project developments, MLP SE's guidance for FY’25 remains within reach, sustaining a 'BUY' recommendation with a target price of €13.00.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de MLP AG