sur MTU Aero Engines Holding AG (ETR:MTX)

MTU Aero Engines Launches New Convertible Bond Offering

MTU Aero Engines AG has announced the launch of a new offering of senior unsecured convertible bonds totaling EUR 600 million, maturing in 2033. Concurrently, the company is inviting investors to sell their outstanding convertible bonds due 2027, amounting to EUR 500 million. This dual strategy aims to optimize MTU’s capital structure and mitigate dilution risks associated with the existing bonds.

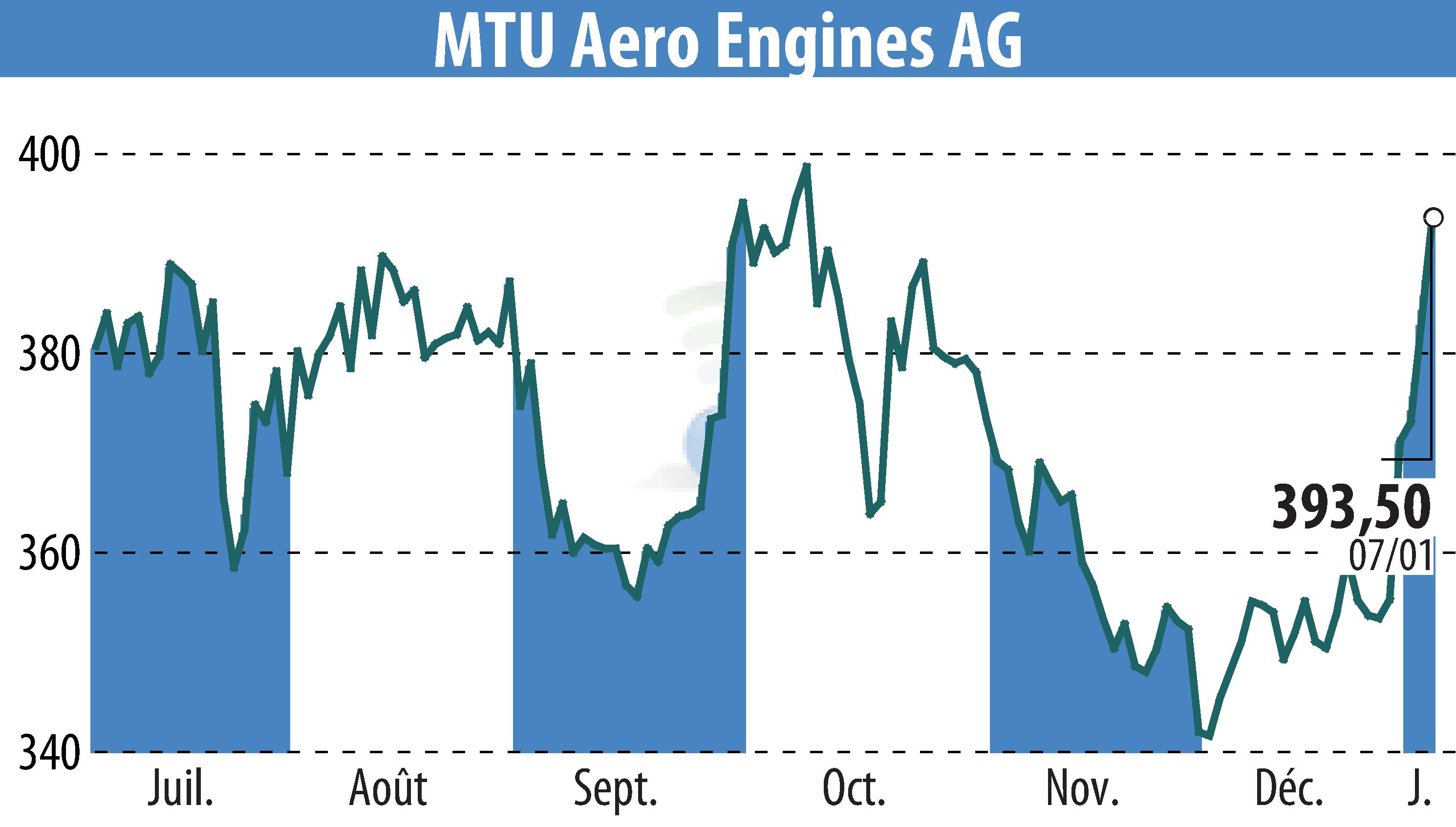

The new bonds will mature over seven and a half years, with a coupon rate between 0.125% and 0.625%. The conversion price will have a premium of 42.5% to 47.5% above the reference share price on XETRA. Settlement of this issuance is expected by mid-January 2026.

The company is targeting institutional investors for this offering, excluding several restricted regions including the US and Japan. BNP PARIBAS, Deutsche Bank, and HSBC are acting as joint coordinators for the transaction, supporting MTU’s efforts to extend its debt maturity profile.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de MTU Aero Engines Holding AG