sur Sektkellerei Schloss Wachenheim AG (ETR:SWA)

Schloss Wachenheim AG: Sales Decline but Optimism for Q4

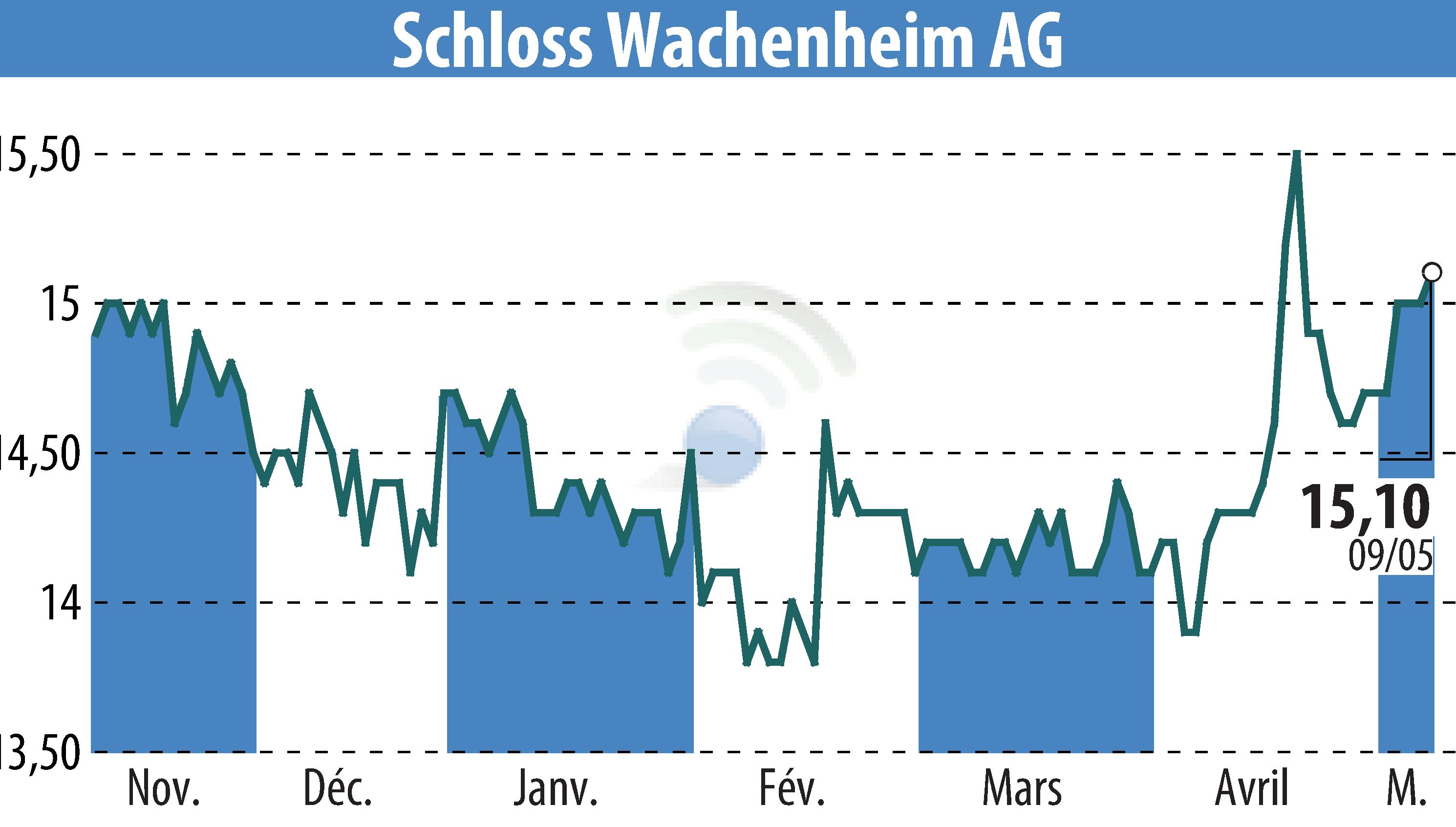

First Berlin Equity Research has released an update on Schloss Wachenheim AG. Analyst Simon Scholes confirmed a "Buy" recommendation but adjusted the target price from €22 to €21 due to recent earnings results. Q3 2024/25 saw a 0.7% sales drop to €86.5 million, with EBIT hitting €-2.4 million.

Sales in Germany and France increased by 4.9% and 3.2%, respectively. However, East Central Europe experienced a 9.6% sales decline, attributed to weaker consumer sentiment amidst economic uncertainties. Initially, management anticipated a 5% sales growth for 2024/25. Now, they foresee a 4% rise, with EBIT at the lower end of the €31-€33 million range.

Despite challenges, a 12% growth rebound is expected in Q4 24/25. Falling inflation and interest rates are projected to benefit SWA long-term. Buy recommendation remains, with reduced earnings forecasts accounting for weak Q3 results.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de Sektkellerei Schloss Wachenheim AG