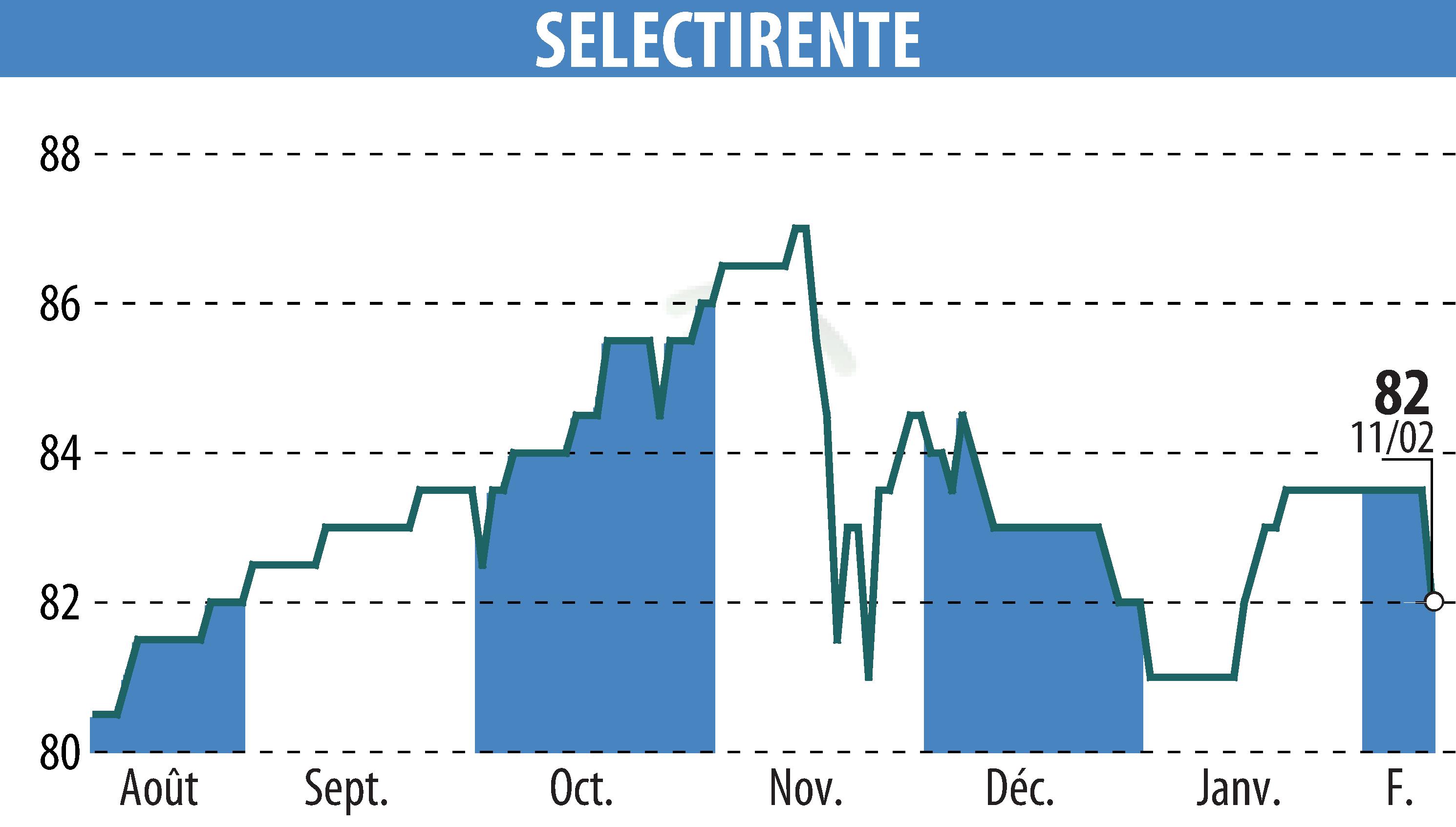

sur SELECTIRENTE (EPA:SELER)

SELECTIRENTE Reports Solid Financial Performance for 2025

For SELECTIRENTE, 2025 marked a strong year with notable acquisitions facilitated by enhanced investment capacity. The company implemented a targeted operational strategy amidst a favorable phase in the property cycle. The financial year concluded with a slight increase in portfolio valuation to €577 million, marking a 1.8% growth.

Investment activities resulted in €18.7 million in acquisitions with an average yield of 6.5%, while disposals amounted to €12.4 million, generating €6.9 million in distributable gains. The rental income grew by 3.5% like-for-like, reaching €30.0 million.

The EPRA LTV debt ratio showed improvement, decreasing to 33.3% from 34.9%, and the average cost of debt rose slightly to 2.47%. A proposed dividend increase to €4.20 per share reflects a 2.4% rise year-over-year.

The company is poised to continue its investment strategy with a renewed focus on financial growth, leveraging its substantial liquidity and strong positioning within urban centers. SELECTIRENTE looks to optimize its portfolio and maintain solid operational performance, even amidst macroeconomic uncertainties.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de SELECTIRENTE