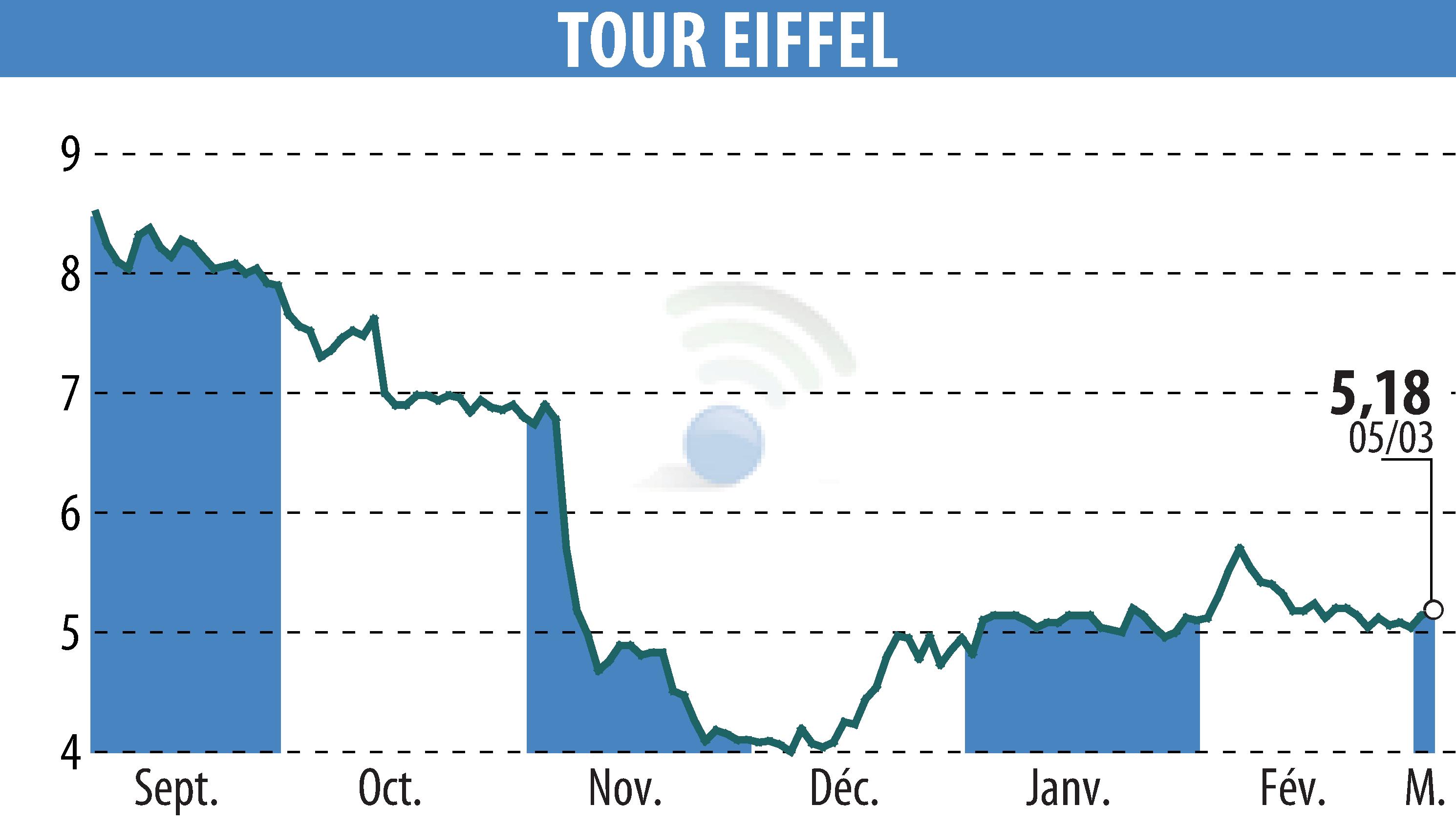

sur TOUR EIFFEL (EPA:EIFF)

The Eiffel Tower Company publishes its 2024 annual results

In 2024, Société de la Tour Eiffel navigated a complex real estate market, impacting its financial indicators. The Board of Directors approved the annual accounts, noting a consolidated net income of -€59.2 million, compared to -€47.2 million the previous year. The value of the assets decreased by 5.8% at constant scope, amounting to €1.6 billion. The capital increase of January 2025, of €598.8 million, made it possible to restore balance sheet balance to support sustainable transformation projects.

The 2024 disposals generated €84.5 million, in a context of portfolio rationalization. Efforts are focused on innovative projects with high environmental performance, such as EvasYon or Nanturra, aiming for BREEAM Excellent certification. At the same time, the Company maintained its rental management policy, despite an occupancy rate down to 76.3%.

In 2025, the Company intends to strengthen its commitment to sustainability and continue its development momentum, supported by its shareholders.

R. E.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de TOUR EIFFEL