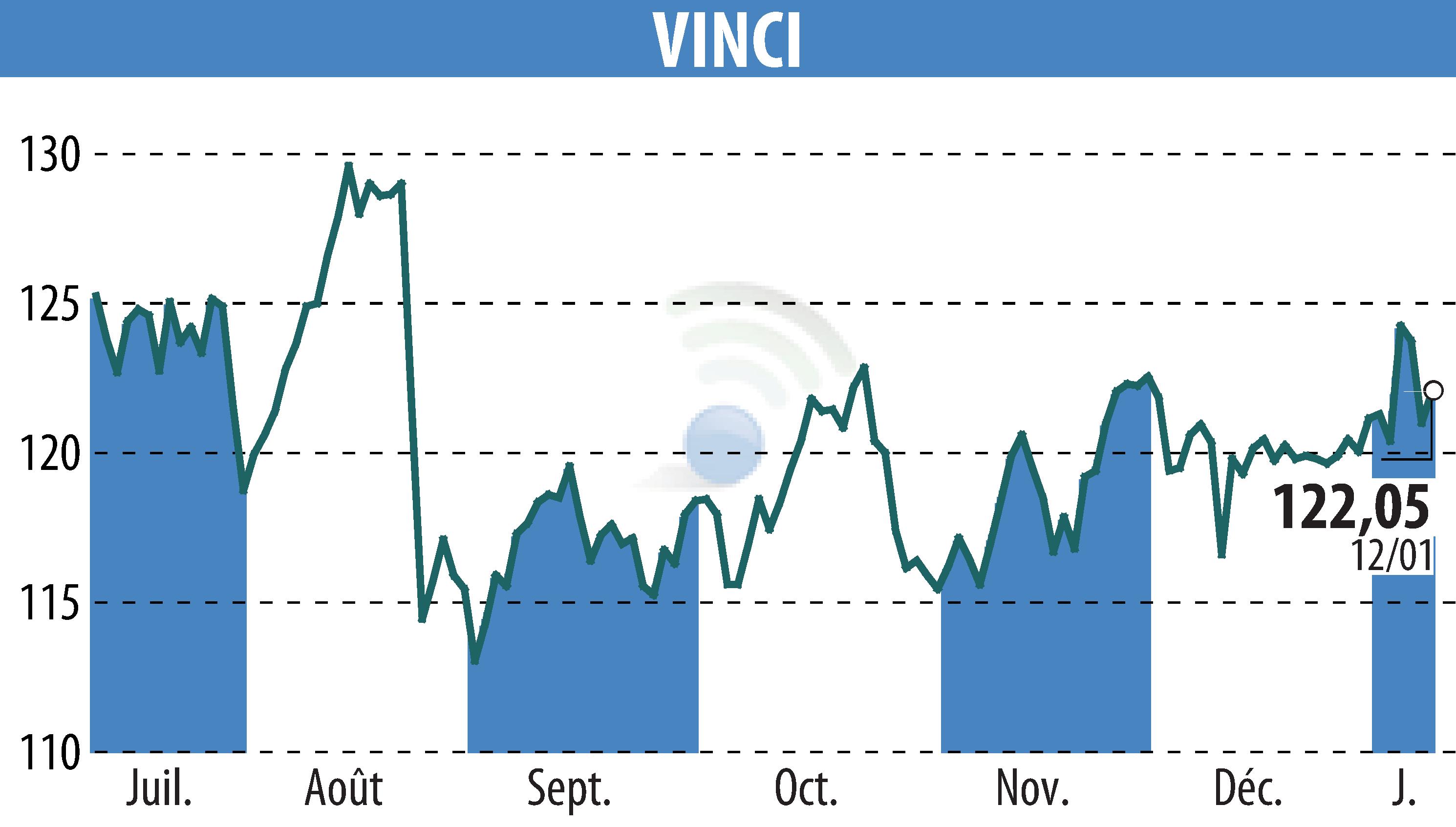

sur VINCI (EPA:DG)

ASF successfully raises funds with a €500 million bond.

ASF, a VINCI subsidiary, has successfully completed a €500 million bond issue maturing in January 2034, with an annual coupon of 3.375%. The transaction was highly successful, being nearly four times oversubscribed. This demonstrates investor confidence in the company's credit quality, rated A- by Standard & Poor's and A3 by Moody's, both with stable outlooks.

This initiative is part of ASF's EMTN program and allows the company to extend the average maturity of its debt. The terms of this issuance are considered excellent, especially in the current market environment.

The main financial participants in this operation were BNP Paribas, Natixis, BofA Securities, CaixaBank, Commerzbank, NatWest Markets NV, RBC Capital Markets and Santander.

R. P.

Copyright © 2026 FinanzWire, tous droits de reproduction et de représentation réservés.

Clause de non responsabilité : bien que puisées aux meilleures sources, les informations et analyses diffusées par FinanzWire sont fournies à titre indicatif et ne constituent en aucune manière une incitation à prendre position sur les marchés financiers.

Cliquez ici pour consulter le communiqué de presse ayant servi de base à la rédaction de cette brève

Voir toutes les actualités de VINCI