par Churchill Resources Inc. (CVE:CRI)

Churchill Intersects High Tenor Antimony and Discovers a Significant New Gold-Silver System at Black Raven, Central Newfoundland

TORONTO, ON / ACCESS Newswire / January 5, 2026 / Churchill Resources Inc. ("Churchill" or the "Company") (TSXV:CRI.V) is pleased to report maiden intersections of high tenor antimony along with gold and silver over 800m of structural continuity in the environs of the historic Frost Cove Antimony Mine. As well the Company reports the discovery of a potentially extensive polymetallic system at Pomley Cove Pond, with interceptions of high-grade gold, silver, lead, and zinc.

These discoveries are a product of Churchill's Fall 2025 exploration program at the Black Raven Project, designed to rigorously evaluate the Frost Cove Mine structure for antimony, and explore the potential for broader polymetallic mineralization through the Black Raven Property. This maiden program consisted of 50 diamond drillholes, with a cumulative depth of 5,176m, along with extensive channel and soil sampling. Thirty holes, totalling 2,743m depth, were dedicated to Frost Cove and the remaining holes to adjoining targets at Stewart, Taylor's Room, and the "wildcat" program at Pomley Cove Pond. This news release provides results for 16 Frost Cove drillholes along the northern 400m of the structure, as well as all channel samples acquired to date at Frost Cove and Pomley Cove Pond. Thirty-four drillholes are still to be reported.

Churchill interprets these partial results as indicating, consistent with its preliminary exploration model, that the Black Raven Property potentially contains a large-scale mineralized system in which strategic and precious metals are genetically linked to felsic intrusive and extrusive rocks. True to the Greek etymology of antimony (antimonos means "never alone"), early indications suggest that antimony at the Frost Cove Mine appears to be the highly-visible manifestation of a large, deep-seated volcanic heat source that may have driven multiple pulses of mineral-rich fluids containing antimony, arsenopyrite and high-grade gold, silver along with other metals within a volcanic-plutonic structural architecture.

Maiden Program Antimony, Gold, Silver Discovery Highlights Include:

Exceptional, high-grade antimony assays from at Frost Cove Mine (Figs. 1& 2).

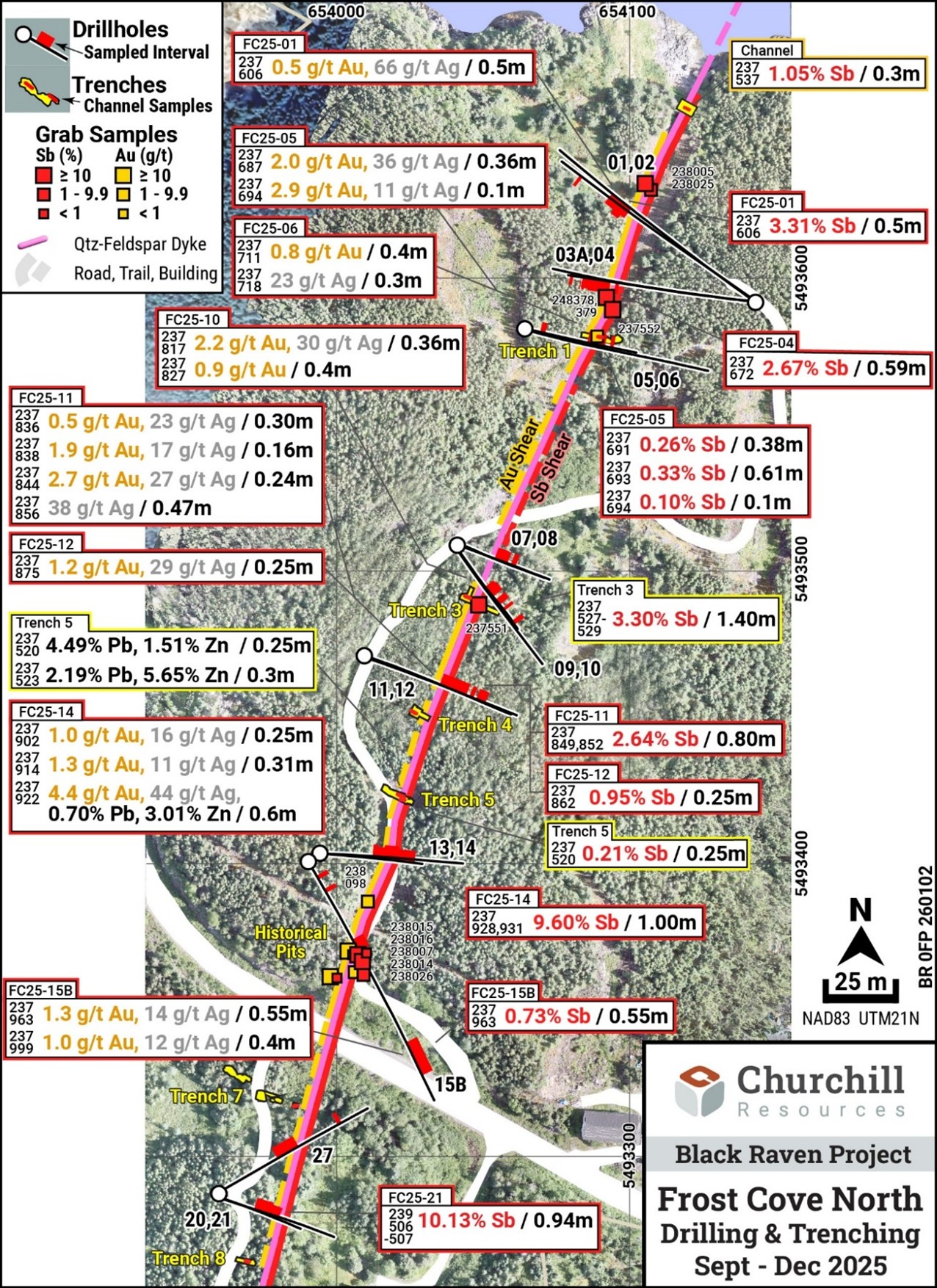

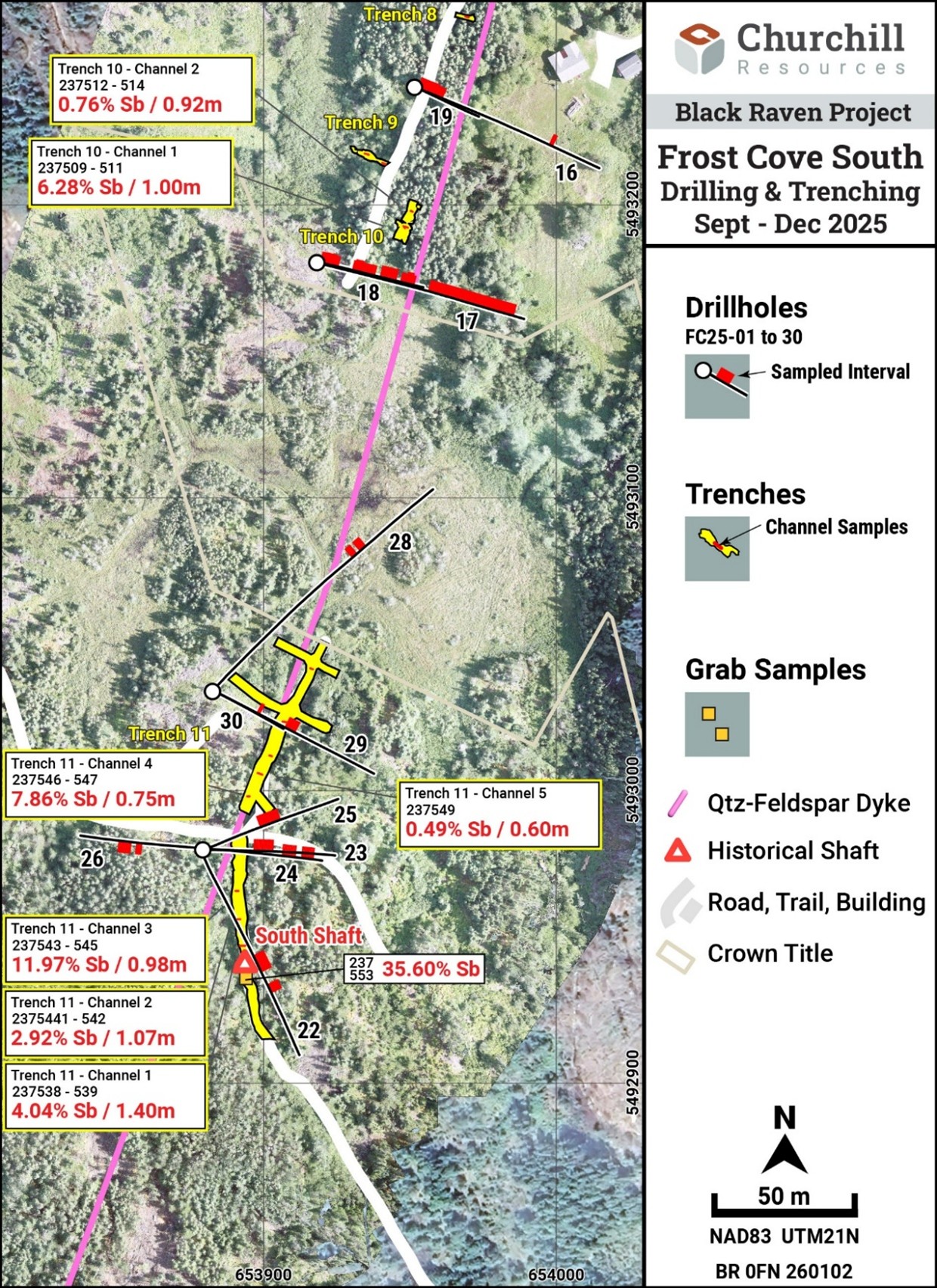

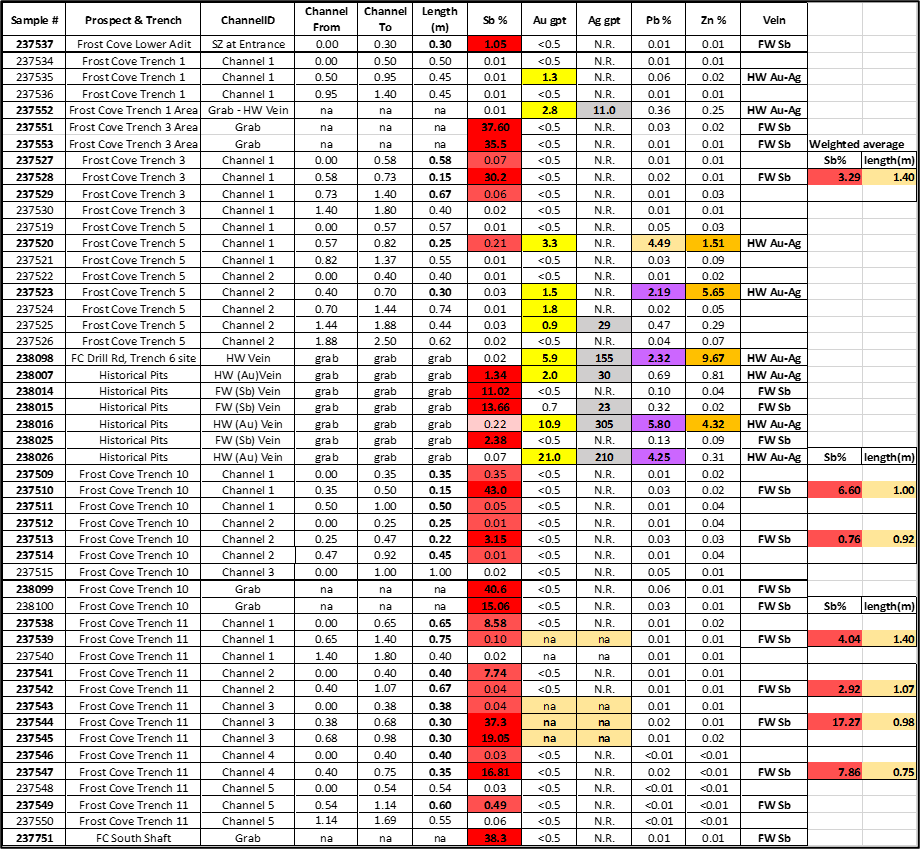

Assay results from 16 drill holes (with 14 still to report) and 18 channel samples have defined a high-tenor shear-hosted zone with structural continuity over a strike length of 800m to approximate depths of 100m; the zoneremains open long strike and to depth:Surface (trenching - Table 1 ) : Systematic saw-cut channel sampling has confirmed consistent, high-grade antimony (Sb) widths across the shear zone, including:

Trench 11: 37.3% Sb over 0.30m within17.27% antimony over 0.98 in Channel 3; and 16.81% over 0.35m within 7.86% Sb over 0.75m in Channel 4.

Trench 10: 43.0% Sb over 0.15m within 6.60% Sb over 1.0m. For reference, 43% Sb represents an equivalent stibnite purity of approximately 59.97%, i.e., approaching the molecular maximum of Sb of 71.7% in stibnite (Sb 2 S 3 ).

Subsurface (drilling - Table 2) : Intersections include:

15.85% Sb over 0.46m within a broader mineralized interval of 10.1% Sb over 0.94m in hole FC25-21.

9.6% Sb over 0.65m, within a broader interval of 6.25% Sb over 1.0m in hole FC25-14.

6.97% Sb over 0.30m, within 2.64% Sb over 0.8m in hole FC25-11

Parallel gold-silver system delineated at Frost Cove Mine trend, hosted in a second arsenopyrite-bearing shear zone 1 to 3 m from the antimony shear zone. High grade gold and silver grab samples confirmed by drilling and trenching include:

2.0 g/t Au and 36 g/t Ag over 0.36m in hole FC25-05

2.2 g/t Au and 30 g/t Ag over 0.36m in hole FC25-10

4.4 g/t Au and 44 g/t Ag over 0.60m in hole FC25-14

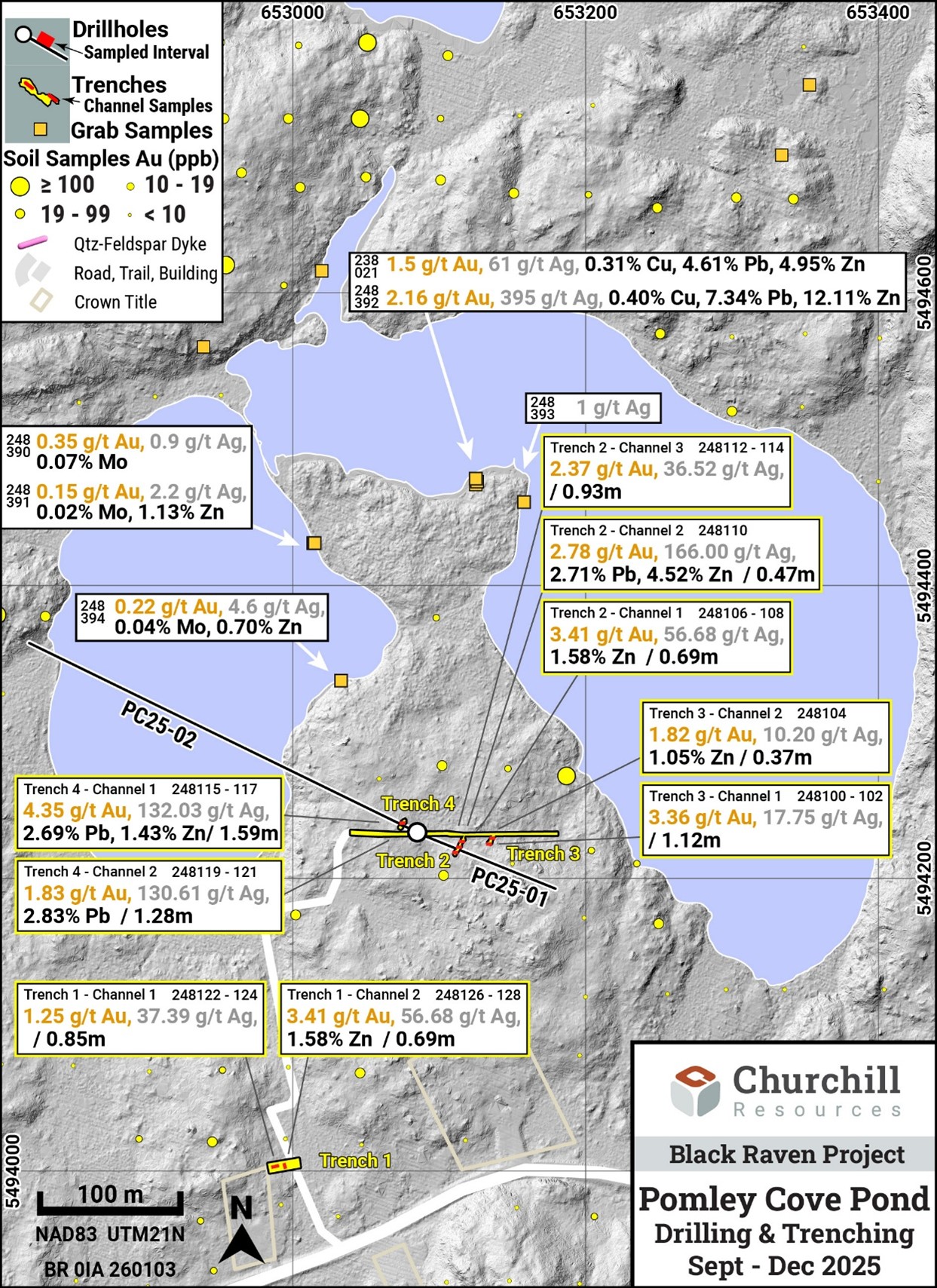

New gold-silver vein system at Pomley Cove Pond (Figure 3).

Nine systematic channels along separate sulphide-rich shear zones as exposed in four trenches along with extensive soil samples have confirmed a high-grade gold-silver-lead-zinc-arsenopyrite system approximately 1km northwest of the historical adits at Frost Cove Mine:Surface (trenching Table 3) : Intercepts include the following (weighted averages):

4.35g/t gold and 132.03 g/t silver over 1.59m (TRPC-04)

3.41% g/t gold and 56.68 g/t silver over 0.69m (TRPC-01)

3.36 g/t gold and 17.75 g/t silver over 1.12m (TRPC-03)

Subsurface (drilling ): The 2025 program concluded December 19 th with two holes drilledbeneath the discovery trenches. Hole PC25-02 also extended out under the pond, where silicious felsic rocks with elevated polymetallic assays had been located along the shoreline during the summer . The surface veins were intersected at depth along with several new veins. Hole PC25-02 encountered approximately 150m of brecciated and sulphide mineralized felsic volcanic rocks, the first such lithologies discovered on the property. Early impressions suggest that Pomley Cove Pond may be a central locus to the overall Black Raven mineralization system.

Pending news flow.

Laboratory assays remain pending : For 14 drill holes along the Frost Cove Mine trend, 12 drill holes and six channel samples at the Taylors Room Prospect, six drill holes at the historic Stewart Gold Mine, as well as the Pomley Cove drilling. The Company continues to build out a unified project model for Black Raven as complete data sets are received.

2026 Exploration : Presently expected to focus on identified centres of mineralization to expand the strategic antimony and high-grade precious metals footprint across the Black Raven Project. Management is preparing to aggressively follow-up up on these discoveries with the 2026 exploration season to commence in mid-February.

Metallurgy: As previously reported by Churchill, the visual and density contrast of high-grade stibnite compared to country rock make it and ideal candidate for sensor-based pre-concentration that allow for rejection of a significant portion of waste rock. Churchill's investigations will continue through 2026 based on the high-grade tenor reported here.

Treasury: With a strong treasury and no immediate need for capital, the Company is well positioned to re-activate its exploration program at Black Raven in 2026.

Figure 1 - Frost Cove North Sheet Sampling Results to 01-02-2026

Figure 2 - Frost Cove South Sheet Sampling Results to 01-02-2026

Figure 3 - Pomley Cove Pond Sampling Results to 01-02-2026

Commented Paul Sobie, President of Churchill Resources: "This maiden program is the culmination of six months of continuous evaluation and exploration where we followed clues not only from the Frost Cove Mine trend, but also from the entire Black Raven Project. We are reporting high antimony grades at Frost Cove that are along a structural framework over 800m in length and to a vertical depth of 100m (remaining open along strike and at depth), with massive stibnite seams intersected in several locales at surface, and to shallow depths thus far. With our discovery of a parallel, high-grade gold-silver shear at Frost Cove, and the newly discovered gold-silver system at Pomley Cove Pond, the polymetallic scale is significantly greater than ever previously contemplated. Perhaps most exciting of all is the potential we are looking at an integrated mineralized system that is clearly intensifying, with potential in gold, silver, antimony and other metals."

Conan McIntyre, CEO added: " The polymetallic discoveries we report today, alongside high-grade antimony,meaningfully supports our mission of supporting strategic resource sovereignty and a ‘Made-in-Canada' antimony supply chain. They add resilience and robustness to that initiative from a capital allocation and risk management perspective, while also unlocking the potential upside of a major precious metals discovery ."

About the Black Raven Gold-Silver-Antimony Project

The Black Raven Project is a polymetallic exploration asset in Central Newfoundland characterized by high-tenor antimony mineralization and a perceived property-wide gold-silver-antimony system. Churchill's primary objective is to evaluate the project's potential as a small-footprint, high-grade underground mine, intending first to gather sufficient data to support the preparation of initial resource estimates and advance towards the formulization of a National Instrument 43-101 compliant maiden resource, thus positioning the property as a potential primary supply source for North American and European markets. Currently, North America lacks sources of high-grade, primary antimony supply, making a potential domestic source at Frost Cove critically important.

The project encompasses the past-producing Frost Cove Antimony Mine and Stewart Gold Mine. While these sites operated intermittently at the turn of the last century, Churchill is the first to apply modern systematic exploration techniques to resources definition for the trend. Black Raven is located approximately 60km northwest of Gander, Newfoundland, and approximately 100km north of the dormant Beaver Brook Antimony Mine. The project benefits from excellent infrastructure, including roads, power, proximity to tidewater and ports, and locally integrated operational and technical teams.

Antimony is recognized as a vital critical mineral, essential for Canada's national and economic security. It is a key component in military applications, flame retardants, alloy strengthening in batteries, and emerging energy storage technologies. Securing a reliable domestic supply chain for antimony is paramount for critical mineral supply chains, bolstering both economic resilience and strategic independence.

About Churchill Resources

Churchill Resources Inc. is a Canadian exploration company focused on exploration and evaluation of strategic and critical metals in Canada, principally at its prospective Black Raven, Taylor Brook and Florence Lake properties in Newfoundland & Labrador. The Churchill management team, board, and advisors have decades of combined experience in mineral exploration and in the establishment of successful publicly listed mining companies, both in Canada and around the world. Churchill's Newfoundland and Labrador projects have the potential to benefit from the province's large and diversified minerals industry, which includes world class mines and processing facilities, and a well-developed mineral exploration sector with locally based drilling and geological expertise.

Qualified Person

The technical and scientific information in this news release has been reviewed and approved by Dr. Derek H.C Wilton, P.Geo., FGC, who is a "qualified person" as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). Dr. Wilton is an honorary research professor of Economic Geology at Memorial University in St. John's and is independent of the Company for the purposes of NI 43-101.

Sampling Program

Antimony, gold, silver, lead, zinc, copper and molybdenum samples were collected by Company geologists from drill cores, channel samples, and grab samples. Core samples were halved by saw at the Company's core facility near Boyd's Cove. All samples were labelled and securely bound and delivered to the laboratory of SGS Canada Inc. in Lakefield, Ontario, for crushing and pulverizing. Splits were analysed by SGS using GE_AAS33E50 assay protocols and by their ore-grade analytical methods when the initial detection limits were exceeded. Qualified Person Dr. Derek Wilton has examined all of the channel sampling sites and all drill holes reported herein.

Churchill Engages Bunt Capital for Investor Relations Services

The Company also announces it has entered into a twelve-month agreement with Bunt Capital Corporation ("Bunt Capital"), based in Toronto, Ontario, to provide investor relations services to the Company. Bunt is a full-service marketing and consulting services company focused on the junior metals and mining sector. Bunt will communicate directly with existing shareholders, analysts and prospective investors. Under the agreement, Bunt Capital will provide investor relations and capital-markets advisory services, including institutional and family-office outreach and coordination of non-deal roadshows.

The Company will pay Bunt Capital C$7,500 per month plus applicable taxes, invoiced monthly in arrears, from working capital, for a total of C$90,000 plus taxes over the twelve-month term. Bunt may from time to time acquire or dispose of securities of the Company through the market, privately or otherwise, as circumstances or market conditions warrant. Bunt has also agreed to the Company's insider trading policy and will observe the Company's trading blackouts. Bunt and its affiliates are at arm's length to the Company and has no other relationship with the Company, except pursuant to the engagement agreement. The engagement is subject to acceptance of the TSX Venture Exchange.

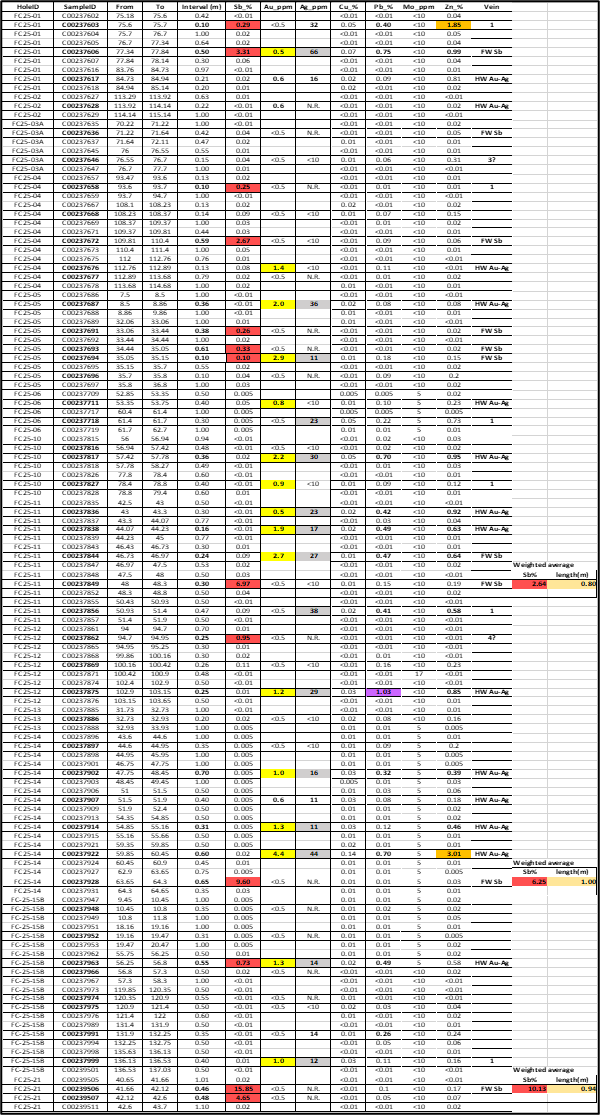

Table 1 - Frost Cove Surface Sample Summary Results to 01-02-2026 [1]

Table 2 - Frost Cove Drillcore Sample Summary Results to 01-02-2026

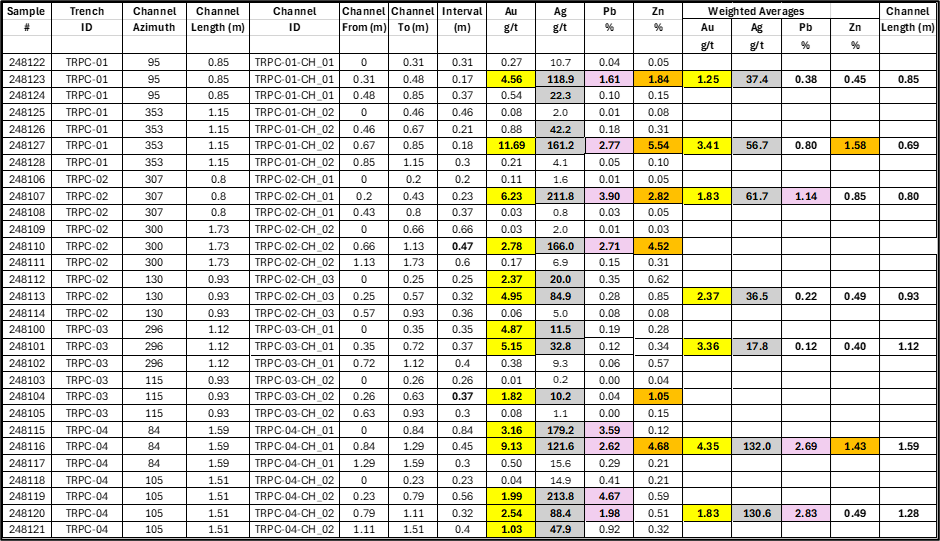

Table 3 - Pomley Cove Pond Channel Sample Summary Results to 01-02-2026

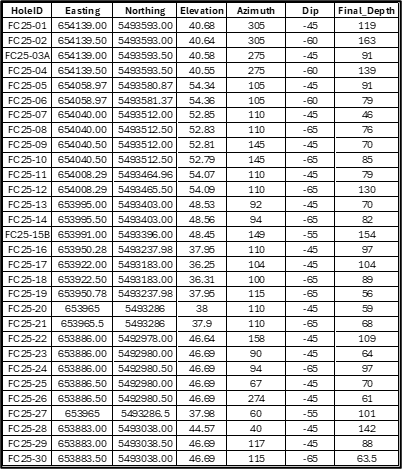

Table 4 - Frost Cove Drillhole Collar Information

Further Information

For further information regarding Churchill, please contact:

Churchill Resources Inc.

Conan McIntyre, Chief Executive Officer

Tel. 416.272.4738

Email: cmcintyre@churchillresources.com

Paul Sobie, President

Tel. 416.365.0930 (o) 647.988.0930 (m)

Email: psobie@churchillresources.com

FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including, but not limited to, statements about Churchill's objectives, goals and exploration activities proposed to be conducted on its properties; future growth potential of Churchill, including whether any proposed exploration programs at any of its properties will be successful; exploration results; and future exploration plans and costs. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. In particular, this release contains forward-looking information relating to, among other things, the Company's goals and objectives, and future exploration work to be conducted on the Company's Black Raven Antimony Property. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Such factors, among other things, include: exploration results on the Black Raven Antimony Property; the expected benefits to Churchill relating to the exploration proposed to be conducted on its properties; receipt of all regulatory approvals in connection with the transaction contemplated herein; failure to identify any additional mineral resources or significant mineralization; the preliminary nature of metallurgical test results; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on the Churchill's properties, if required; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold, silver, base metals or certain other commodities; change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations pressures, cave-ins and flooding); inability to obtain adequate insurance to cover risks and hazards; the presence of laws and regulations that may impose restrictions on mining and mineral exploration; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); the unlikelihood that properties that are explored are ultimately developed into producing mines; geological factors; actual results of current and future exploration; changes in project parameters as plans continue to be evaluated; soil sampling results being preliminary in nature and are not conclusive evidence of the likelihood of a mineral deposit; and title to properties. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Churchill cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Churchill assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

[1] FW = footwall; HW = hanging wall.

SOURCE: Churchill Resources Inc.

View the original press release on ACCESS Newswire