par Infield Minerals Corp. (CVE:INFD)

Infield Minerals Announces Letter of Intent for an Option to Acquire the Detroit Sediment-Hosted Gold Property in Utah

VANCOUVER, BC / ACCESS Newswire / February 19, 2026 / Infield Minerals Corp. (TSX-V:IN) ("Infield" or the "Company") is pleased to announce that it has signed a non-binding letter of intent dated February 19, 2026 (the "LOI"), to enter into an option agreement to acquire 100% interest in the Detroit sediment-hosted gold property ("Detroit" or the "Property") in Utah.

"We are excited to expand our project portfolio in Utah with a second sediment-hosted gold property that has demonstrated potential for additional discovery and upside," stated Evandra Nakano, President and CEO of Infield. Ms. Nakano continued, "Our technical team continues to uncover considerable opportunities in the State, where properties at attractive valuations remain underexplored within significant mineral trends."

Property Highlights:

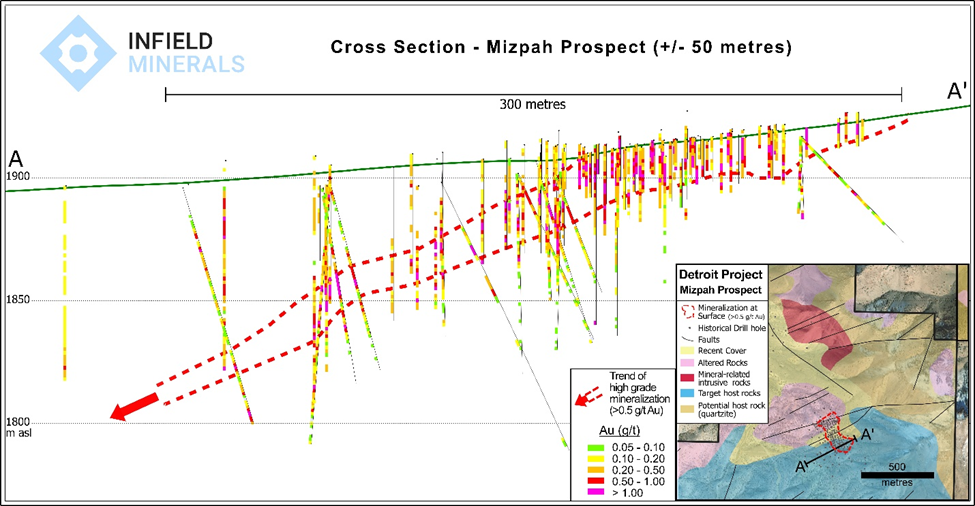

The Mizpah mineralized zone hosts a 500 metre by 300 metre open-ended sediment-hosted gold system with potential for expansion

Historical Mizpah drilling results1 include:

2.14 grams per tonne ("g/t") gold over 10.7 m (from surface; MZ-049)

2.67 g/t gold over 7.6 m (from 19.8 m; MZ-104)

1.19 g/t gold over 21.3 m (from 3.0 m; MZ-87-032)

Including 2.69 g/t gold over 7.6 m

1.51 g/t gold over 16.8 m (from 3.0 m; MZ-87-048)

Including 2.20 g/t gold over 10.7 m

1.87 g/t gold over 13.7 m (from 30.5 m; MZ-87-052)

Hole ended in mineralization (10.01 g/t gold in a 1.5-m sample)

Large magmatic-hydrothermal footprint with reactive carbonate host rocks is favourable for additional discovery

Easy logistics with established infrastructure, accessible road network traversing the Property, local mining culture and skilled workforce in Utah

Adjacent to multiple historical mines, including the past-producing open pit Drum mine

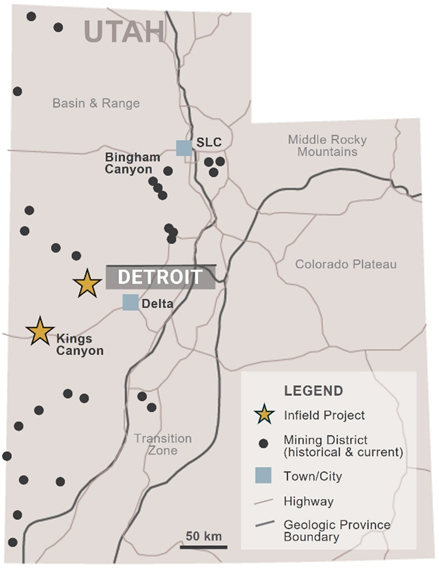

The Detroit project is a compelling exploration opportunity within the Drum Mountains region of western Utah, situated approximately 65 kilometres northwest of the Company's Kings Canyon property and 160 kilometres southwest of the Bingham Canyon mining district (Figure 1). Approximately 5,115 acres of primarily metalliferous mineral leases with the State of Utah (The School and Institutional Trust Lands Administration) and minor unpatented mining claims (Bureau of Land Management) comprise the Property. The Property is located within a vast desert landscape characterized by modest topography and excellent infrastructure, including direct road access from Delta, Utah - less than one hour drive from the project site. This strategic location would enable Infield to leverage significant cost and logistical synergies with the Kings Canyon project.

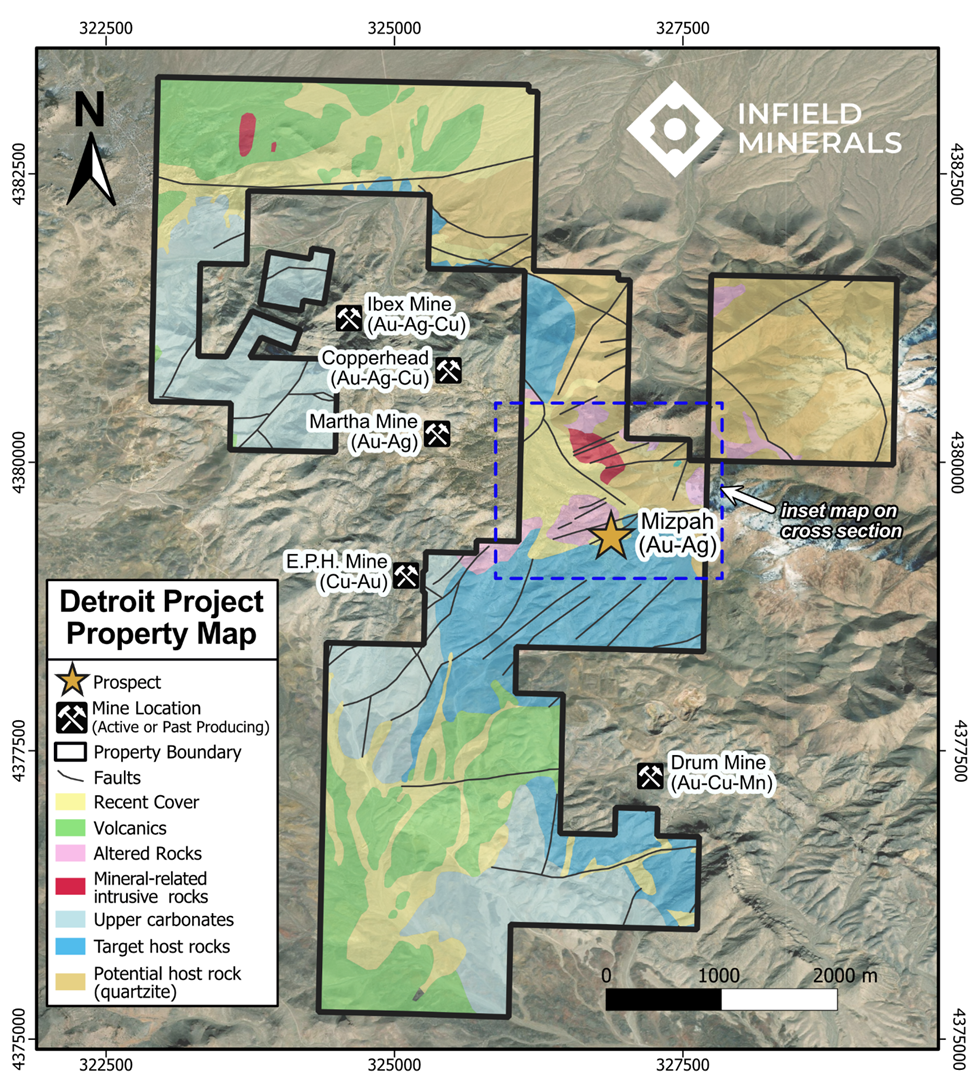

Mining history in the Drum Mountains dates back to the late 1800s when gold, copper and manganese were extracted from the area2. Metal endowment in the district is showcased by the Mizpah sediment-hosted gold system at the Property, a nearby open-pit past producer (Drum gold mine), as well as numerous small-scale base and precious metal mines (Figure 2). The Drum deposit historically produced 3.2 million tonnes of oxide ore grading 1.23 g/t gold3.

The Property hosts the Mizpah zone, a sediment-hosted disseminated oxide gold deposit with excellent continuity, located only two kilometres north of the past-producing open pit Drum mine. The open-ended mineralized footprint at Mizpah is defined by shallow drilling that measures approximately 500 metres by 300 metres (Figure 3). Historical drilling results in the Mizpah target area range from below detection to 10.01 g/t gold, with highlights including: 10.7 metres grading 2.14 g/t gold from surface in hole MZ-049; 7.6 metres grading 2.67 g/t gold from 19.8 metres downhole in hole MZ-104; 21.3 metres grading 1.19 g/t gold from 3.0 metres downhole in hole MZ-87-032, including 7.6 metres grading 2.69 g/t gold; 16.8 metres grading 1.51 g/t gold from 3.0 metres downhole in hole MZ-87-048, including 10.7 metres grading 2.20 g/t gold; and 13.7 metres grading 1.87 g/t gold from 30.5 metres downhole in hole MZ-87-052 with the hole ending in a 1.5-metre sample grading 10.01 g/t gold4.

The Detroit property exhibits strong geological potential that is characterized by a highly reactive package of host rocks overprinted by hydrothermal systems. Extensive alteration across the Property includes silicification, argillization, marblization, as well as gossan zones. The existing database includes over 200 historical drill holes, rock and soil sampling, ground magnetics and induced polarization geophysics. Infield's experienced technical team will look to build upon this dataset while applying a fresh approach to exploration in the area, with a view to outline targets for drill testing.

Infield Minerals is committed to building shareholder value with mineral exploration discoveries in the Western United States. The Company is actively evaluating additional base metal and gold exploration opportunities with a view to expanding its portfolio with projects of merit. Potential acquisitions are vetted for optimal exploration discovery odds, combined with favourable commercial deal terms, in Tier 1 jurisdictions.

Option Terms

Subject to the execution of a definitive agreement, Hawk Resources Limited ("Hawk") will grant Infield the right to acquire 100% interest in the Property in consideration for completion of the following cash payments, and for which Infield may satisfy one-half of any of the cash payments by issuing the equivalent value of common shares in the capital of the Company:

$40,000 upon execution of the Definitive Agreement and TSX Venture Exchange approval of the proposed transaction;

$60,000 upon the first-year anniversary of the Definitive Agreement;

$80,000 upon the second-year anniversary of the Definitive Agreement;

$100,000 upon the third-year anniversary of the Definitive Agreement;

$120,000 upon the fourth-year anniversary of the Definitive Agreement; and

$150,000 upon the fifth-year anniversary of the Definitive Agreement.

Additionally, the following cash payments shall apply if the associated milestones set forth below are achieved, and Infield may satisfy up to one-half of any of such cash payments by issuing the equivalent value of common shares in the capital of the Company:

Hawk shall be entitled to a one-time payment equal to $1.25 for each ounce of gold identified the earlier of: (i) a Measured or Indicated mineral resource; or (ii) a Proven or Probable mineral reserve, as contained in a technical report prepared in accordance with National Instrument 43-101, subject to a 250,000 ounce minimum; and

Hawk shall be entitled to a one-time payment of $1,000,000 upon achievement of aggregate production from the Property of no less than 7,500 ounces of gold.

Qualified Person

Technical information in this news release has been reviewed and approved by Andrea Diakow, P.Geo., a geological consultant and a Qualified Person as defined by National Instrument 43-101.

The potential quantity and grade of mineralization described herein is conceptual in nature as there has been insufficient exploration to define a mineral resource and it is uncertain if further exploration will result in targets being delineated as a mineral resource.

For more information, please contact Evandra Nakano, the CEO, President and a director of the Company, at +1 (604) 220-4691 or email: info@infieldminerals.com

On Behalf of the Board of Directors of Infield Minerals Corp.

Evandra Nakano

President, CEO & Director

About Infield

Infield Minerals is currently exploring for gold within the U.S. Great Basin. Our mission is to grow and deliver value through discovery, acquisitions and sustainable development of high quality, high potential assets for the social and economic benefits of our stakeholders. Founded in 2020, Infield is led by a team of mining entrepreneurs with extensive technical and resource evaluation experience.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Statements included in this announcement, including statements concerning Infield's plans, intentions and expectations, which are not historical in nature, are intended to be, and are hereby identified as, "forwardâlooking statements". Forward-looking statements include, among other matters, executing a definitive agreement for the Detroit property option and TSX-V's acceptance thereof, Infield's exploration plans, including for the Detroit property, timing of future consideration payments and achieving milestones on the Property, and plans for future acquisitions. Forwardâlooking statements may be, but are not always, identified by words including "anticipates", "believes", "intends", "estimates", "expects" and similar expressions. Infield cautions readers that forwardâlooking statements, including without limitation those relating to Infield's future operations and business prospects, are subject to certain risks and uncertainties (including geopolitical risk, regulatory, and exchange rate risk) that could cause actual results to differ materially from those indicated in the forwardâlooking statements. There can be no assurance that any forward-looking statement will prove to be accurate or that management's assumptions underlying such statements, including assumptions concerning future developments, circumstances or results, will materialize. The forward-looking statements included in this news release are made as of the date of this new release and Infield does not undertake to update or revise any forward-looking information included herein, except in accordance with applicable securities laws.

1 Historical drilling results noted were collected by a third party (Western States Minerals Corp. and Western States Mining Inc.), independent from Infield, and analysed by fire assay at Barringer Laboratories Inc. in 1987. No quality assurance / quality control information is available, and Infield has not verified the historical drilling results. The reader is cautioned not to treat the historical results as current and that a qualified person has not done sufficient work to verify the results and that they may not form a reliable guide to future results. The Company considers the historical results to be relevant and the results are provided for information purposes only and may be used as a guide to plan future exploration and drilling programs. True thicknesses of the mineralized intervals have not been calculated, but are estimated to be ≥90% of the drilled interval.

2 Crittenden at el., 1961, Manganese Deposits in the Drum Mountains, Juab and Millard Counties, Utah, Contributions to Economic Geology, Geological Survey Bulletin 1082-H.

3 Berger, V.I. et al., 2014, Sediment-hosted gold deposits of the world: Database and grade and tonnage models, USGS Open-File Report 2014-1074.

4 Historical drilling results noted were collected by a third party (Western States Minerals Corp. and Western States Mining Inc.), independent from Infield, and analysed by fire assay at Barringer Laboratories Inc. in 1987. No quality assurance / quality control information is available, and Infield has not verified the historical drilling results. The reader is cautioned not to treat the historical results as current and that a qualified person has not done sufficient work to verify the results and that they may not form a reliable guide to future results. The Company considers the historical results to be relevant and the results are provided for information purposes only and may be used as a guide to plan future exploration and drilling programs. True thicknesses of the mineralized intervals have not been calculated, but are estimated to be ≥90% of the drilled interval.

SOURCE: Infield Minerals Corp.

View the original press release on ACCESS Newswire