par Silver X Mining Corp. (CVE:AGX)

Silver X Extends Blenda Rubia Mineralization 160 Metres Below Historic Workings; Intersects High-Grade Silver Within Broad Multi-Vein Zone

VANCOUVER, BC / ACCESS Newswire / January 26, 2026 / Silver X Mining Corp. (TSXV:AGX)(OTCQB:AGXPF)(F:AGX) ("Silver X" or the "Company") is pleased to announce results from the first three underground diamond drill holes completed as part of its deep exploration program at the Blenda Rubia Mine, within the Nueva Recuperada Project in central Peru. The program successfully extends silverâpolymetallic mineralization upto 160 metres below the historically mined levels, confirming the vertical continuity of the system and intersecting multiple veins and veinlets, including a broad mineralized zone of 27.4 metres true width

"We are very encouraged by the first results from our deep drilling program at Blenda Rubia, which demonstrate that mineralization continues well below the historic mine workings and remains open for expansion," said Jose Garcia, CEO and President of Silver X. "The wide, structurally robust mineralized zone intersected in BR-003, including a high-grade silver core, highlights the scale potential of this system and reinforces our view that Blenda Rubia could become an increasingly important contributor to the Nueva Recuperada complex. The close proximity to our processing infrastructure provides a strong advantage as we continue to convert exploration success into future development opportunities."

Blenda Rubia is a past-producing underground mine, next to the Recuperada mill; previously operated until the mid-1990s. Historic mining activities were largely confined to shallow levels, with development and exploration reaching only four levels in depth below surface (Level 210), despite historical evidence for a vertically extensive silver-polymetallic system. Mining ceased during a period of significantly lower silver prices and domestic turbulence, which averaged approximately US$5-6 per ounce1 at the time, limiting the economic extraction of deeper mineralization.

Highlights:

Mineralization extended up to 160 metres below historic mine levels, confirming strong vertical continuity and demonstrating meaningful potential to expand mineral resources beyond previously mined areas.

All three drill holes intersected mineralized veins at mineable widths and grades, reducing geological risk and increasing confidence in the consistency of the vein system at depth.

Hole BR-003 intersected a broad 27.4-metre true width multi-vein zone, including a high-grade core of 3.0 metres averaging 505 g/t Ag, 4.16% Pb and 0.49% Zn, highlighting the presence of both scale and high-value mineralization within the same structural corridor.

The wide mineralized zone hosts multiple sub-parallel veins and dense silver-bearing veinlets, indicating a structurally robust system capable of supporting larger-tonnage underground mining scenarios rather than narrow, isolated veins.

Grades increase with depth in portions of the system, suggesting potential for improving metal endowment and stronger economics as drilling advances below historic workings.

Blenda Rubia is located approximately 2 km from Silver X's processing plant, providing a clear pathway for capital-efficient development and potential near-term integration into future mine plans if resources are defined.

Drill Interceptions:

BR-001

Intersected 2.0 m true vein width (4.55 m apparent width) averaging 98 g/t Ag, 1.25% Pb and 0.04% Zn.

Intercepted approximately 65 m below Level 210 at an elevation of approximately 4,175 metres above sea level.

Confirms the down-dip continuity of the Blenda Rubia structure at mineable widths.

The intercept is located within the central portion of the Blenda Rubia vein system.

Mineralization occurs in two discrete vein/breccia zones, separated by a 40 cm barren horse, followed by a zone of alteration, suggesting the presence and continuity of multiple sub-parallel structures along the drill hole.

Mineralization is hosted in vein and vein-breccia zones characterized by strong silica, with patchy polymetallic sulfide mineralization dominated by galena and sphalerite, minor pyrite (~1%), and possible silver-bearing sulfosalts, accompanied by localized hydrothermal argillic alteration adjacent to the vein system.

BR-002

Intersected 1.0 m true vein width (2.2 m apparent width) averaging 123 g/t Ag, 0.95% Pb and 0.02% Zn.

Intercepted approximately 165 m below Level 210, at an elevation of approximately 4,050 metres above sea level.

Confirms the down-dip continuity of the Blenda Rubia structure below historic mine workings.

The intercept is located within the central portion of the Blenda Rubia vein system, approximately 50 metres west of BR-001 and more than 100 metres below its intercept.

Mineralization occurs within a principal vein/breccia interval, flanked by internal barren horses, indicating a structurally controlled mineralized system with persistence at depth.

Mineralization is hosted in vein and vein-breccia zones characterized by intense silicification, brecciated textures, and polymetallic sulfide mineralization dominated by fine-grained pyrite, with argentiferous galena, locally associated with silicified breccias and hydrothermal argillic alteration halos developed within structurally controlled zones.

BR-003

Intersected a 27.4 m true width (54.85 m apparent width) zone of veining, within which a 3.0 m true width (6.0 m apparent width) vein stands out, grading 505 g/t Ag, 4.16% Pb and 0.49% Zn.

Intercepted approximately 25 m below Level 210, at an elevation of approximately 4,190 metres above sea level.

The intercept is located within the central portion of the Blenda Rubia vein system, stepping out to the west of BR-001 and BR-002.

Mineralization is hosted within a structurally controlled, broad multi-vein system, characterized by strong silica flooding and brecciation, with patchy polymetallic sulfide mineralization dominated by pyrite, with local galena and possible silver-bearing sulfosalts, developed within strongly silicified wall rock, and accompanied by moderate veinlet development, hydrothermal alteration halos, and local barren horses.

Strategic Importance of the Drill Program

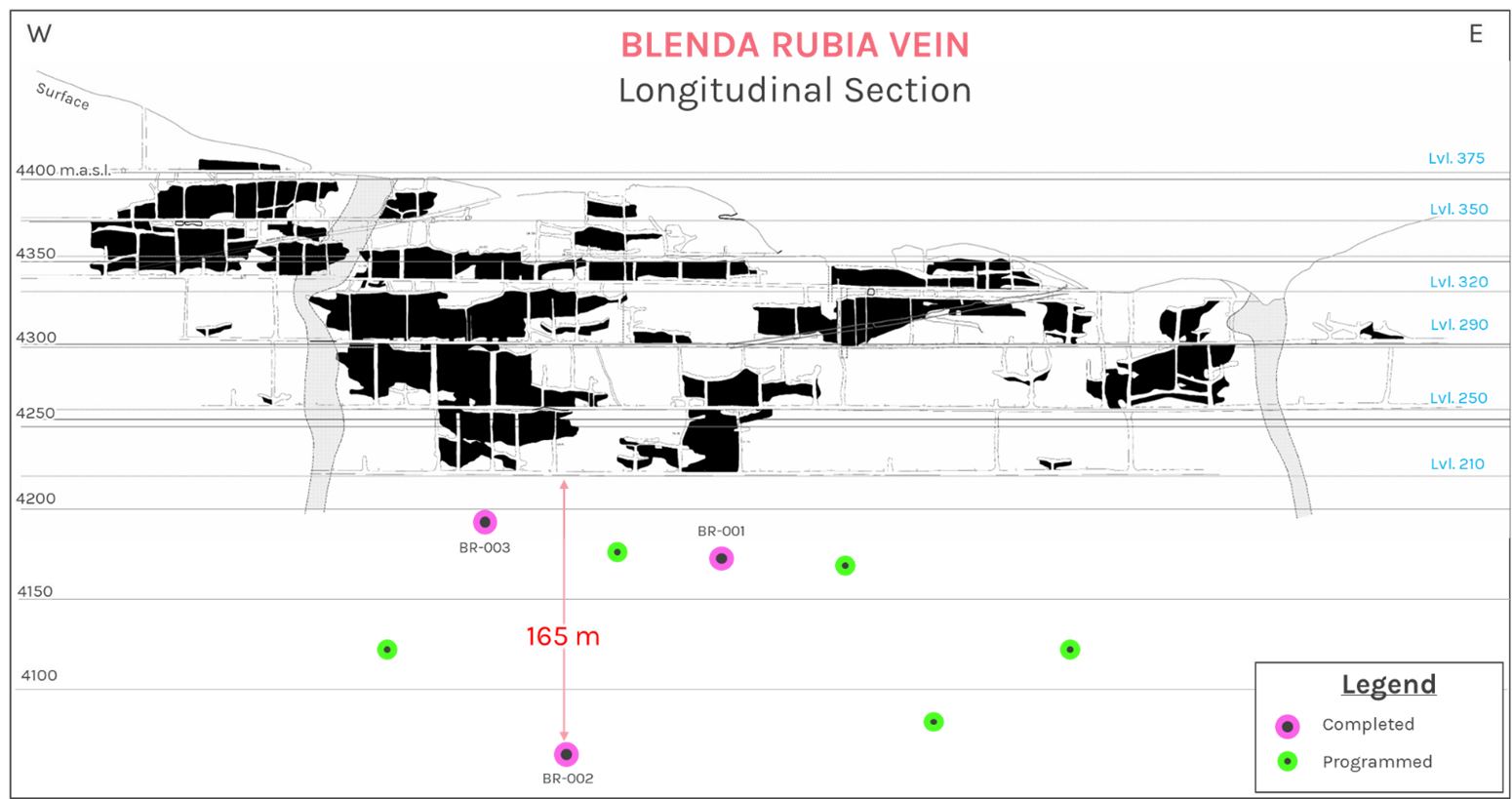

The current drill program specifically targets the depth continuation of the Blenda Rubia vein system below Level 210, representing the first modern drilling campaign designed to evaluate the vertical extent of mineralization beneath historic mine workings (Figure 01).

Silver X is developing an exploration program based on a two-pronged strategy:

Systematically testing the down-dip extension of the Blenda Rubia structure, which had not been explored.

Evaluating historically mined and under-mined areas to identify remnant and adjacent mineralized zones with potential for recovery under a conceptual mine plan

The Blenda Rubia Mine is located approximately two kilometres from Silver X's processing plant, providing a clear potential pathway for rapid integration into future mine plans should mineral resources be defined.

Drill Results Summary

(See Table 01 for assay details and Figure 01 for drill hole locations and intercept geometry)

Figure 01: Longitudinal Section of the Blenda Rubia Vein Showing Historic Mine Workings and Current Deep Drill Holes Below Level 210.

Validation of Continuity and Grade Evolution at Depth

The first two drill holes (BR-001 and BR-002) successfully demonstrate that the Blenda Rubia structure maintains geological continuity below historic workings, with widths that are considered operationally mineable in a future underground scenario.

While BR-002 returned a narrower intercept relative to BR-001, the higher silver grade (approaching 125 g/t) is interpreted as evidence of metal enrichment with depth, a characteristic commonly observed in productive silver-polymetallic vein systems in the region.

Table 01: Summary of Initial Deep Drill Results Below Historic Level 210 at Blenda Rubia (True Widths)[2].

Elevation (m) | Drill Hole | From (m) | To (m) | Apparent Width (m) | True Width (m) | Ag (g/t) | Pb (%) | Zn (%) |

4,155 | BR-001 | 260.40 | 265.00 | 4.55 | 2.00 | 98 | 1.25 | 0.04 |

4,060 | BR-002 | 366.20 | 368.40 | 2.20 | 1.00 | 123 | 0.95 | 0.02 |

4,200 | BR-003 | 187.70 | 193.70 | 6.00 | 3.00 | 505 | 4.16 | 0.49 |

Positive Results from BR-003 Highlights Scale Potential

Drill hole BR-003 represents a step-out to the west and delivered the most significant intercept of the program to date. The hole intersected a robust, multi-stage mesothermal mineralized system characterized by strong silicification, polymetallic sulfide mineralization, and continuous veining over a broad interval

Within this mineralized vein system, Silver X identified a high-grade, 505 g/t Ag vein at the hanging wall contact of 3.0 metres true width, accompanied by strong lead and zinc credits, it is accompanied by a smaller veins and veinlets with a true width of 24.4 m. Importantly, this broad mineralized interval has a grade of 28.1 g/t Ag, with 0.36% Pb and 0.09% Zn.

The results demonstrate the presence of a wide, structurally controlled mineralized system characterized by continuous silver mineralization with associated lead and zinc, rather than a narrow or isolated vein. This combination of width, grade continuity, and polymetallic character significantly enhances the potential scalability of the Blenda Rubia system in a future mining scenario.

Implications for Future Exploration and Resource Definition

The results from the first three drill holes are considered highly encouraging and provide strong technical support for Silver X's working hypothesis that Blenda Rubia hosts a vertically extensive and economically attractive silver-polymetallic system.

These results:

Validate the continuity of mineralization below historic mine levels.

Confirm the presence of mineable widths at depth.

Indicate increasing silver grades in certain portions of the system; and

Support the advancement of the Blenda Rubia project through continued exploration drilling toward future mineral resource definition.

Silver X will continue drilling to further evaluate both the down-dip and lateral continuity of the structure, with the objective of converting exploration success into mineral resources that could be rapidly advanced toward production, subject to technical and economic evaluation.

Quality Assurance and Quality Control (QA/QC)

Silver X follows rigorous QA/QC protocols. Channel samples were collected using hammer and chisel to ensure representative sampling of the vein material and immediate wall rock. Samples were dispatched to an ISO-certified laboratory in Lima, Peru. The program includes the regular insertion of certified reference materials (standards), blanks, and field duplicates to ensure the highest level of analytical accuracy.

Please see "Cautionary Note regarding Production without Mineral Reserves" at the end of this news release.

Qualified Person

Mr. A. David Heyl, B.Sc., C.P.G who is a qualified person under NI 43-101, has reviewed and approved the technical content of this news release for Silver X. Mr. A. David Heyl is a consultant for Silver X.

Corporate Update on Trafigura's US$2.0 Million Financing Facility

Further to the Company's news release dated June 24, 2025, which announced a US$2.0 million financing provided by Trafigura, the Company confirms that the first drawdown under this financing, in the amount of US$850,000, was completed on July 21, 2025.

As disclosed in the June 24, 2025 news release, the financing includes the issuance of an aggregate of 2.5 million non-transferable share purchase warrants. The Company is proceeding with the issuance of these warrants at an exercise price of CAD $0.23 per share being the share price at that time, with a term of 15 months from the date of issuance.

This corporate update is unrelated to the Blenda Rubia exploration results described in this news release and is provided to ensure timely disclosure of other corporate matters.

Corporate Update on the Conclusion of Strategic Consulting Service

Further to the Company's news release dated October 30, 2025, which announces the engagement with an independent advisory firm, co-led by Ernesto Balarezo and Patricia Kosa, the Company reports that the strategic consulting service previously disclosed has concluded.

The service included strategic and advisory support provided by Ernesto Balarezo and Patricia Kosa, focused on operational and organizational matters.

Silver X acknowledges their professional contributions and continues to advance its priorities with a focus on operational execution, and long-term value creation.

Cautionary Note regarding Production without Mineral Reserves

The decision to commence production at the Nueva Recuperada Project and the Company's ongoing mining operations as referenced herein (the "Production Decision and Operations") are based on economic models prepared by the Company in conjunction with management's knowledge of the property and the existing estimate of mineral resources on the property. The Production Decision and Operations are not based on a preliminary economic assessment, a pre-feasibility study or a feasibility study of mineral reserves demonstrating economic and technical viability. Accordingly, there is increased uncertainty and economic and technical risks of failure associated with the Production Decision and Operations, in particular: the risk that mineral grades will be lower than expected; the risk that additional construction or ongoing mining operations are more difficult or more expensive than expected; and production and economic variables may vary considerably, due to the absence of a detailed economic and technical analysis in accordance with NI 43-101.

About Silver X

Silver X is a rapidly expanding silver producer and developer advancing the Nueva Recuperada Project in Peru, a 20,795-hectare, district-scale land package with two mining units and over 200 targets. Current production at the Tangana Mining Unit is scaling alongside the planned restart of the Plata Mine, supporting a path to ~6 million AgEq ounces annually by 2029. With immediate revenue, scalable growth, and long-term discovery upside - all within one integrated project - Silver X is building the next-generation silver company defined by growth, resilience, and responsible mining.

For more information visit our website at www.silverxmining.com.

ON BEHALF OF THE BOARD

José M. Garcia

CEO and Director

For further information, please contact:

Kaitlin Taylor

Investor Relations

ir@silverxmining.com

+1 778 887 6861

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding "Forward-Looking" Information

This press release contains forward-looking information within the meaning of applicable Canadian securities legislation ("forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain acts, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". All information contained in this press release, other than statements of current and historical fact, is forward looking information. Forward- looking information contained in this press release may include, without limitation, exploration plans, results of operations, expected performance at the Project, the Company's belief that the Tangana system will provide considerable resource expansion potential, that the Company will be able to mine the Tangana Mining Unit in an economic manner, and the expected financial performance of the Company.

The following are some of the assumptions upon which forward-looking information is based: that general business and economic conditions will not change in a material

adverse manner; demand for, and stable or improving price for the commodities we produce; receipt of regulatory and governmental approvals, permits and renewals in a timely manner; that the Company will not experience any material accident, labour dispute or failure of plant or equipment or other material disruption in the Company's operations at the Project and Nueva Recuperada Plant; the availability of financing for operations and development; the Company's ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; that the estimates of the resources at the Project and the geological, operational and price assumptions on which these and the Company's operations are based are within reasonable bounds of accuracy (including with respect to size, grade and recovery); the Company's ability to attract and retain skilled personnel and directors; and the ability of management to execute strategic goals.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company, as the case may be, to be materially different from those expressed or implied by such forward-looking information, including but not limited to those risks described in the Company's annual and interim MD&As and in its public documents filed on www.sedar.com from time to time. Forward- looking statements are based on the opinions and estimates of management as of the date such statements are made. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward- looking information. The Company does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

[1] Silver price historical data sourced from the 2022 World Silver Survey, showing average annual silver prices for 1994-1996 near US $5.2-$5.3 per ounce.

[2] True widths are estimated based on the current interpretation of vein orientation.

SOURCE: Silver X Mining Corp.

View the original press release on ACCESS Newswire